Ethereum’s native token Ether (ETH) rose by approximately 4.5 percent to $3,550 in the last 24 hours. One of the biggest reasons for this rise was the news that the SEC would end its investigation into Ethereum.

“The SEC’s Enforcement Division has announced that it has closed its investigation into Ethereum 2.0,” Ethereum developer ConsenSys said in a statement on June 19. ConsenSys calls this a victory:

“A major victory for Ethereum developers, technology providers and industry participants”

This decision of the SEC came after the approval of spot Ether ETF applications by major Wall Street firms such as VanEck, BlackRock and Fidelity. Bloomberg analyst Eric Balchunas claims that Ether ETFs will begin trading on July 2.

K33 Research predicted that these investment instruments would attract investments worth $4 billion within the first five months after they were launched.

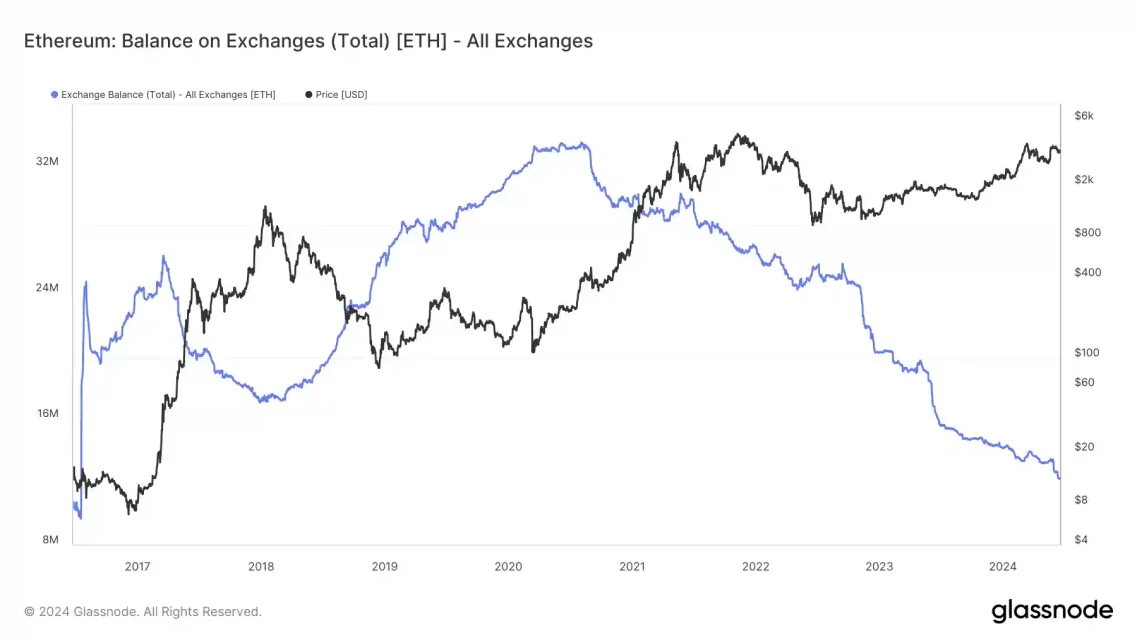

ETH shortage on crypto exchanges

According to data from Glassnode, the total amount of Ether held on crypto exchanges fell to 12.20 million ETH on June 18, the lowest level since July 2016. The increase in Ether outflows from crypto exchanges shows that the selling pressure has decreased in parallel with the price increase of ETH and investors prefer to keep ETH in private wallets or decentralized protocols.

ETH price rebounded from critical support

ETH price turned up again after testing the support level around $3,500 today. This number overlaps with the 50-day exponential moving average (EMA; red wave), the 0.5 Fibonacci retracement level, and the lower trend line of the ascending channel.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making decisions.