Ethereumsupply is experiencing its longest inflationary period since the 2022 upgrades, and blockchain’s March Dencun upgrade may be the reason

According to Ethereum data dashboard ultrasoundmoney, EtherIts supply has been gradually increasing, and more than 112,000 ETH have been added to the total supply since April 14.

Much of the inflationary developments could be a result of the March 13 Dencun upgrade. The upgrade in question brought forward nine Ethereum Implementation Proposals (EIPs), including EIP-4844, which was cited as the primary cause of inflation.

Impact of Ethereum updates

EIP-4844 introduced system blobs (cheap and discontinuous memories that carry information about transactions) that allow discrete and discontinuous storage of process information and reduce the prices paid for block data in ETH layer-2 networks.

In addition, Dencun introduced proto-danksharding, which aims for more efficient data availability for block space on the Ethereum mainnet. Like this AbritrumWhile a large decrease in the cost of processing transactions was observed in Ethereum layer-2 networks such as Optimism and Optimism, as a result, the total amount of ETH burned on the main network also decreased significantly.

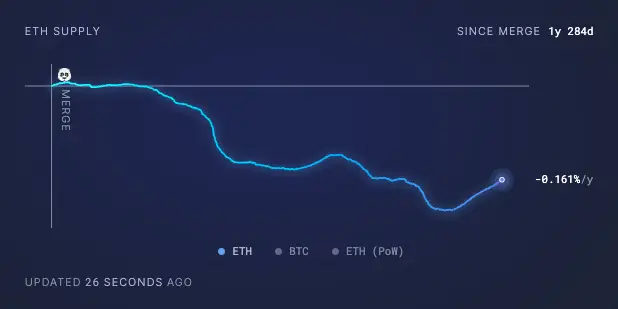

Although ETH supply has been subject to inflation in recent months, total Ether supply has decreased significantly since the Ethereum Merger. In total, more than 1.5 billion ETH has been burned since September 2022, while 1.36 billion ETH has been produced. This development led to a decrease of 345,000 ETH in the total number. The financial cost of the contraction in supply caused by the transition to Proof-of-Stake is currently around 1.1 billion dollars.

These developments on the Ethereum side, and especially the developments in spot ETFs, will have a say in the price structure in the medium/long term. Altcoin investors can follow ETH closely in this process.