In the latest CPI data released in the USA, it is seen that housing inflation has not slowed down. One reason for this is due to measurement imperfection.

There are two methods for measuring housing inflation.

- Actual rents paid by tenants for rented properties

- Changing rents when leases are renewed or tenants move

Equivalent rental value (OER)The data is based on a survey that asked homeowners how much rent they would receive if they were to rent their homes under current market conditions.

There is a significant difference between the OER data and the accommodation expenditures currently included in the CPI.

Graphic:Difference between Survey Data Accommodation Price and CPI Accommodation Price

It takes time for people to renew their leases and move. Therefore, it will take time for price changes to appear in housing inflation metrics.

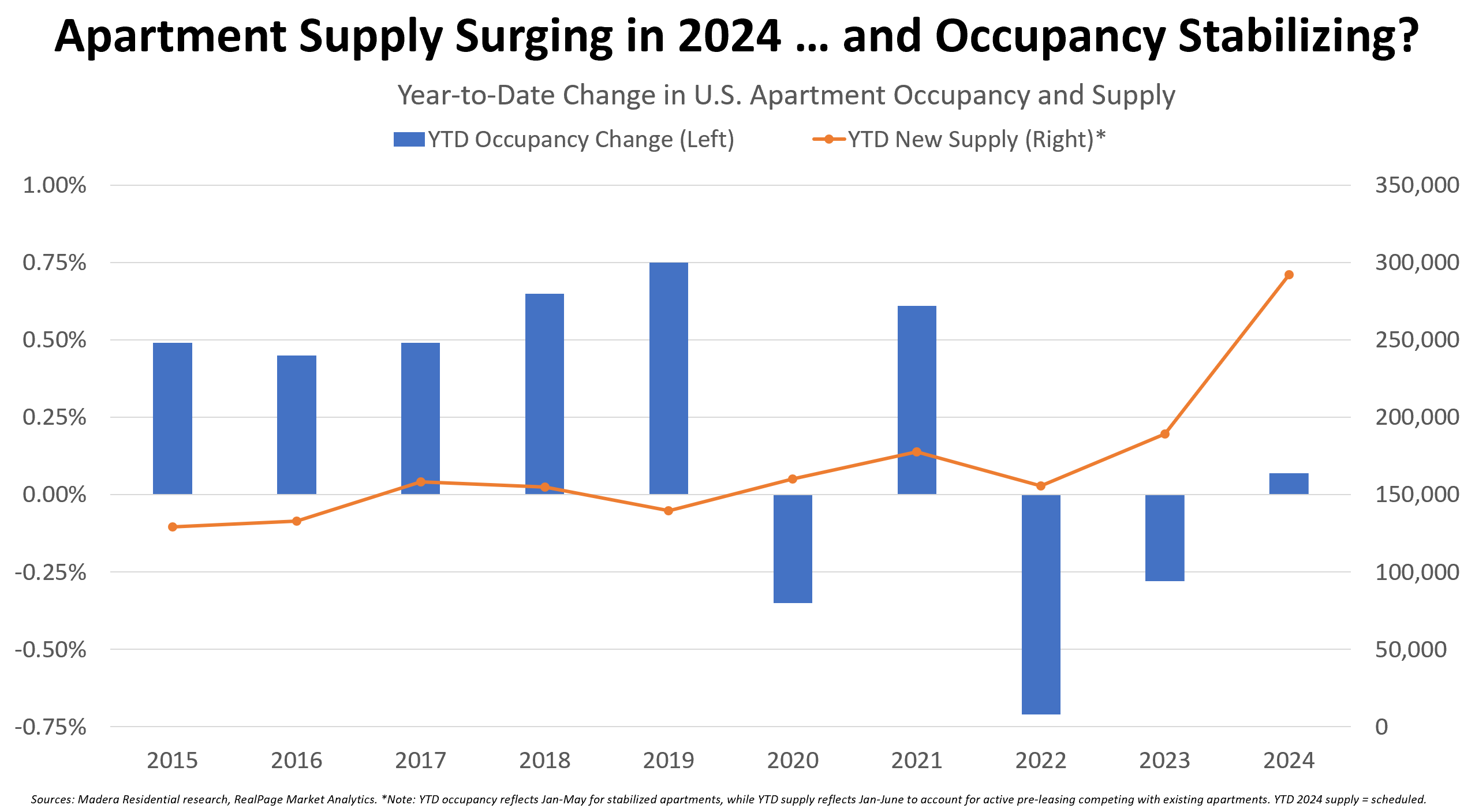

Jay Parsons According to , the first half of 2024 was one of the highest housing supply cycles in the last 30 years. However, demand does not accompany supply to the same extent.

Graphic:Building Use Change and New Housing Supply Between 2015-2024

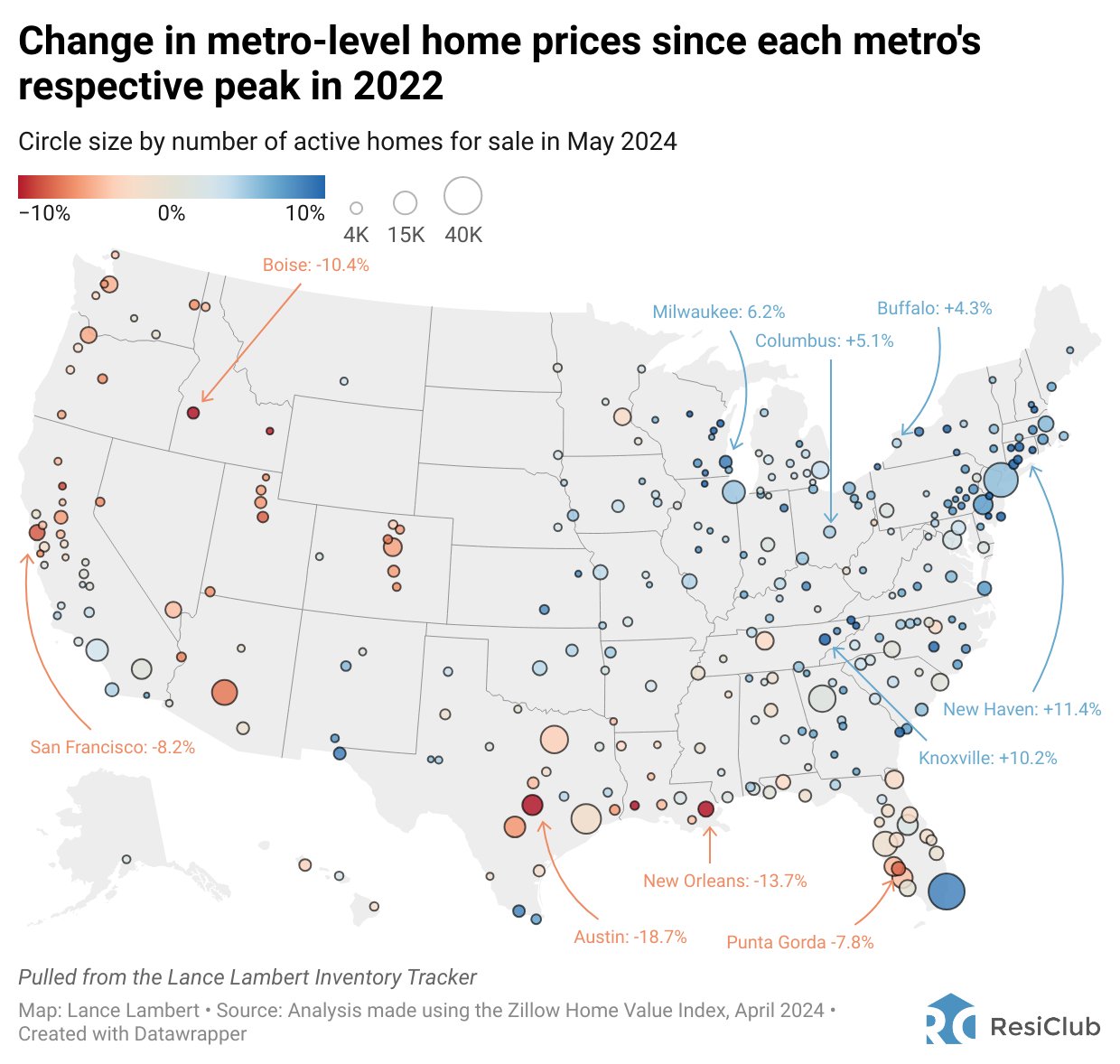

Compared to the new lease contracts, rents remained stable for 11 consecutive months. There appears to be more relief in some housing markets, especially Austin, Texas.

Graphic:Housing Price Changes by Regions in the USA

Various regions where there has been a significant decrease compared to the chart above are as follows:

- Austin -> -18.7%

- New Orleans -> -13.7%

- Lake Charles, LA -> -11.7%

- Boise -> -10.4%

- Idaho Falls -> -9.7%

- Chico, CA -> -8.8%

- San Francisco -> -8.2%

- Provo -> -8.0%

- Punta Gorda -> -7.8%

However, this does not apply to everyone. There are different pricing depending on the regions.

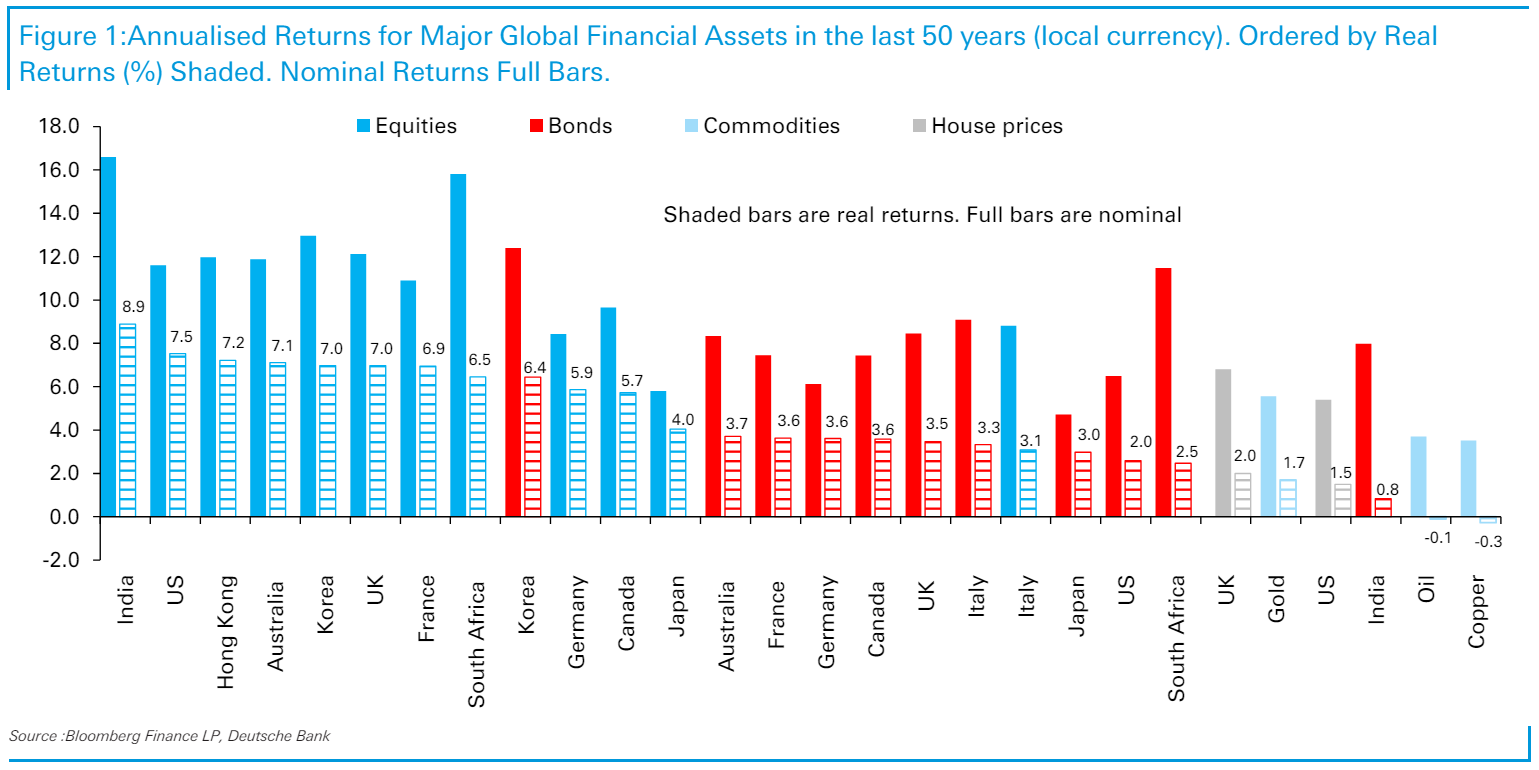

Additionally, it should not be forgotten that housing investment is an individual choice. Although housing does not often yield as much return as other investments, it is preferred as a means of accumulating wealth. In the USA, the ideal situation is home ownership.

The $10,000 invested in stocks in June 1974 is worth $2.4 million today. If the same price had been invested in the home, it would be worth $139,000 today.

Graphic:Annual Returns by Various Regions and Instruments (Line column: Represents real return.)

Housing Market

Deputy Minister of Treasury Wally Adeyemo Compared to , the demand for housing is very high because not enough housing has been built since the financial crisis. The pandemic has only exacerbated this problem. Mortgage interest rates are currently above 6.5% and home prices have more than tripled since the early 1990s.

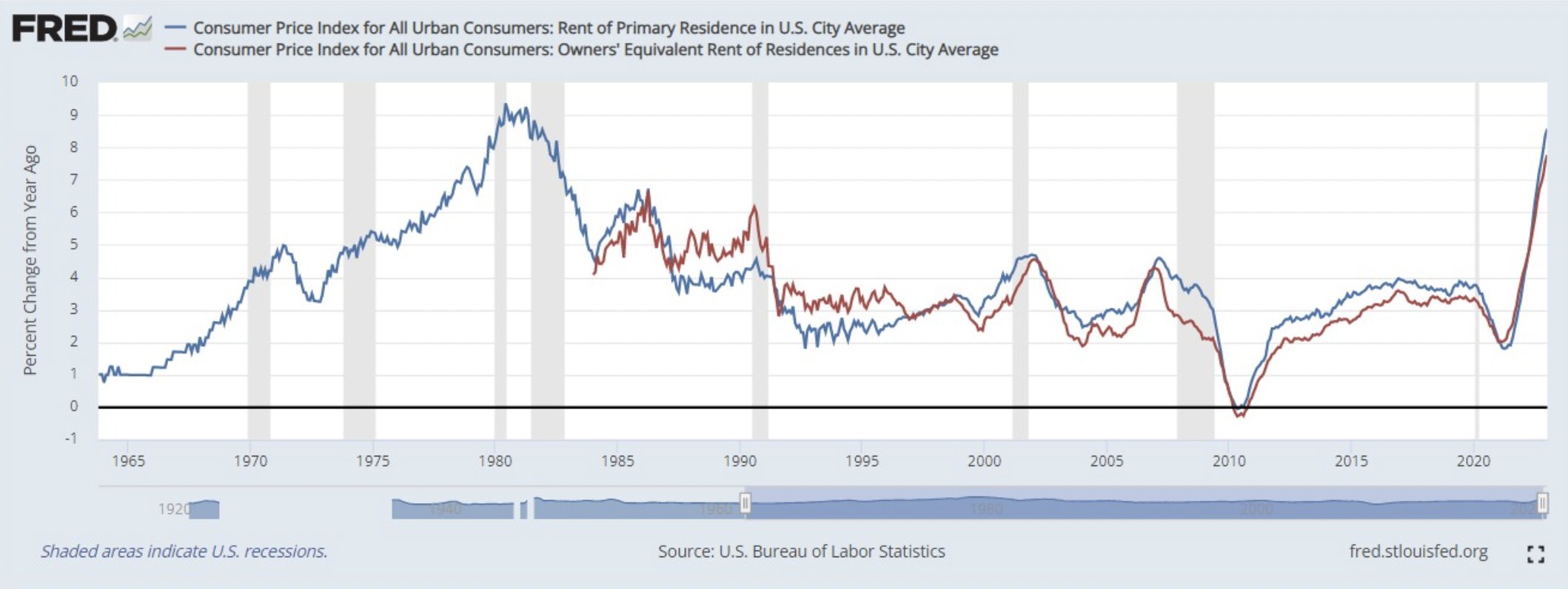

Rents have increased more than or equal to the cost of housing. The rate of increase is at the highest level in the last 40 years. Between May 2021 and mid-May 2022, rents increased by more than 15%, to an average of $2,000.

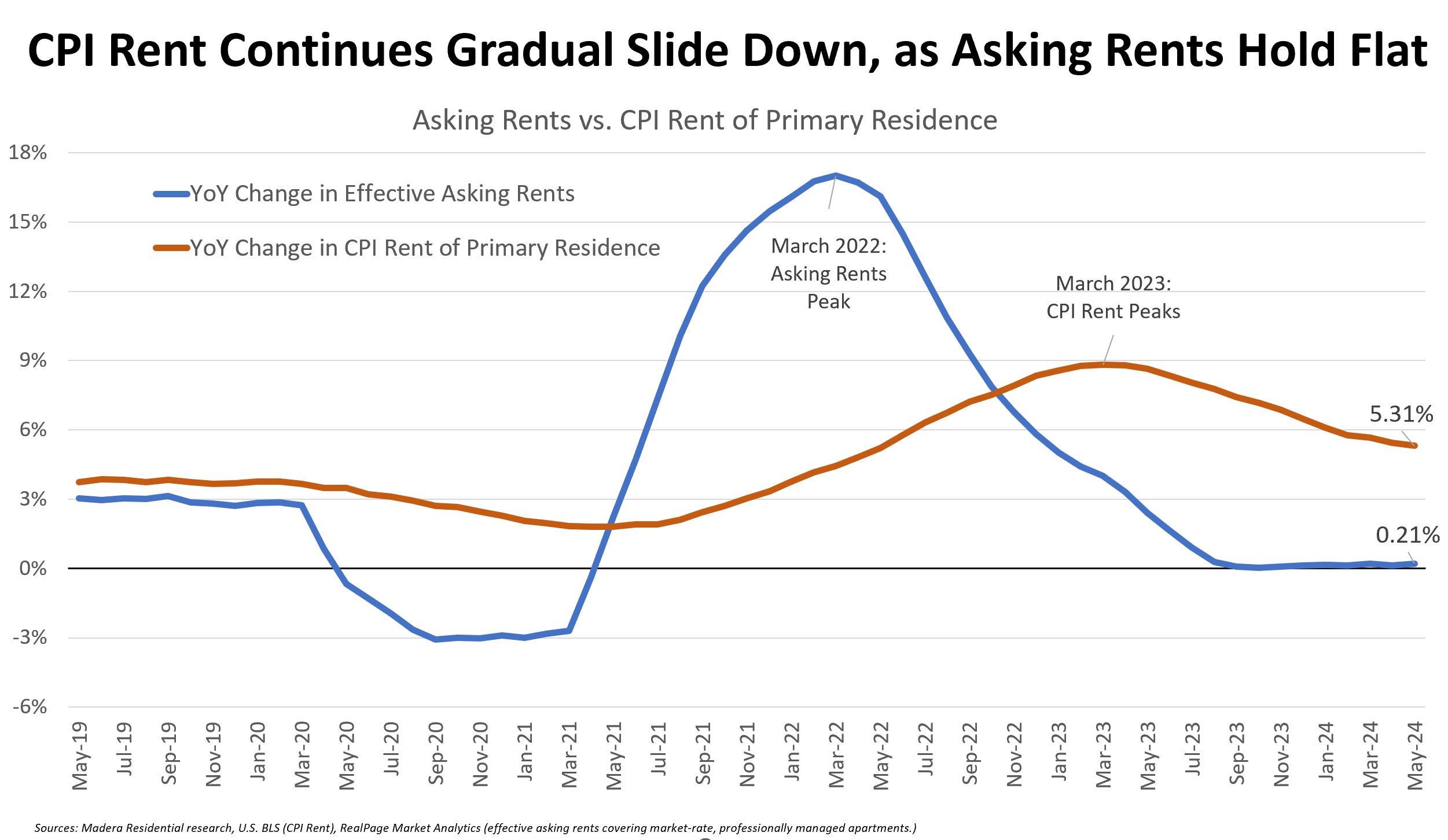

Graphic:1965-Present Annual Rent Change Rates and Equivalent Rental Price

Housing data accounts for more than two-thirds of the CPI. Housing is a valuable problem because it is a basic need. When young people talk about how they experience the economy, they often mean housing prices and rents. Currently, many people feel quite poor due to the cost of housing.

The salient features of different social clusters regarding the housing problem can be described as follows:

- 90% of homeowners with mortgages in the United States are locked into a fixed-rate mortgage. This insulates them from the effects of monetary policies. This serves as a buffer against recession. These individuals may feel like they are ‘house rich but cash poor’.

- Those who will buy a house for the first time face 6.5% mortgage interest rates. This makes them feel incapable of movement.

- There are cash-rich people who bought 70% of the housing in NYC without a mortgage in the last quarter of 2023, making competition difficult.

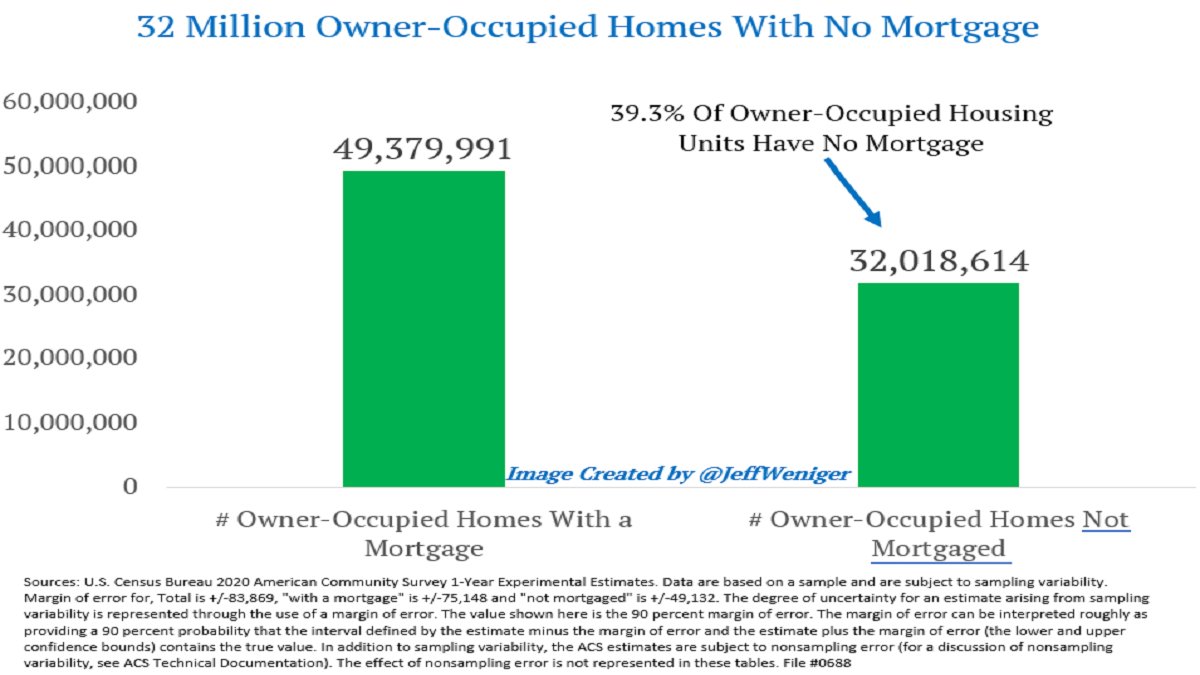

- In addition, 40% of the homeowners, that is, 32 million people, are completely mortgage-free homeowners, the majority of whom are baby boomers.

Graphic:Residential Owners with and without Mortgage

derek thompsonIn his article titled ‘America’s Magical Thinking About Housing’ he uses the following words:

“In the United States, housing is designed to serve opposite roles in society: today’s shelter and tomorrow’s investment vehicle. This lies at the heart of the crisis. “

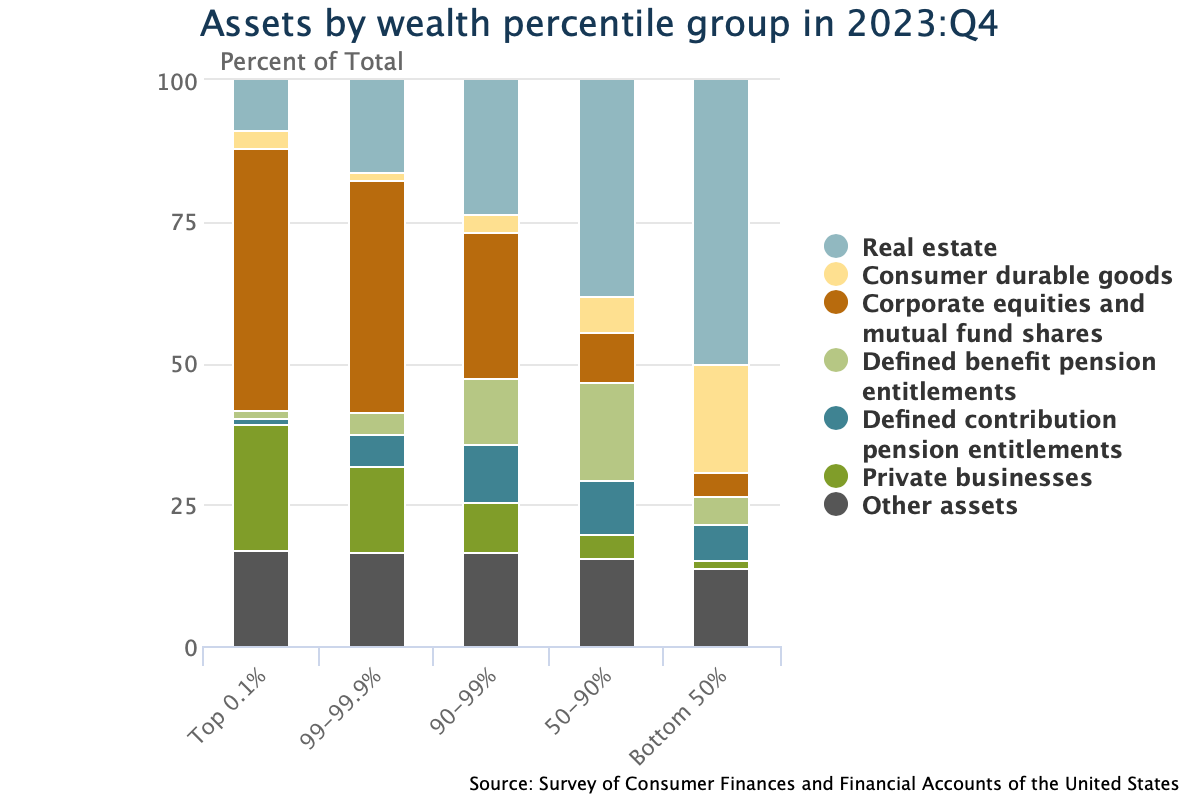

There is an inherent push and pull between housing being a means of creating wealth for the bottom 50% and subsequently being something designed for living and building community. Housing is often preferred as a means of accumulating wealth.

Graphic:Wealth Distribution According to Various Social Classes

Problems with the Housing Market

NIMBYism

NIMBYism is an abbreviation for “Not In My Backyard” and means “Stay away from the building near me.” It is the opposition of a community member to a development or project that will be carried out in the area where he/she lives or in the immediate surroundings, or does not want these developments to take place. This reaction may arise from concern about environmental impacts, decreasing property prices, or decreasing quality of life.

Many older homeowners spend a lot of time blocking new housing development for a variety of reasons. Additionally, elderly people stay in their homes for very long periods of time, partly because elderly care costs $10,000 per month.

56% of homeowners over the age of 60 say they will never sell their homes.

Large tax breaks are also available for seniors to remain in their homes.

At the same time, there is an increase in the number of the young generation living at home.

All these situations lead to the formation of a population that does not want construction near residences.

Climate Change

Climate activists oppose housing supply due to environmental costs. Activists mostly don’t want buildings around them.

zoning

Zoning is a planning and organizing process to assign different usage targets to certain areas or regions. According to Adeyemo, one of the issues facing is that many people do not want more housing.

When there was a housing crisis in the USA in the 1880s, a solution was found by building elevators and rapid rail transit. However, today, downzone policies that make building housing more difficult are preferred, as in San Francisco.

More than 90% of residential space in Los Angeles is zoned for single family. This makes building multiplexes very difficult. Situations such as minimum land sizes, height restrictions, and parking requirements make construction difficult.

Upzoning policies are needed for more housing construction. Upzoning can ease the market by increasing the supply of housing, as happened in Austin, Texas.

Positive Developments Regarding the Housing Market

Grant Programs

The current focus, and one of the most viable ways to lower the cost for all Americans, is to increase the supply of housing. The Low Income Housing Tax Credit adds to this bet. This source has been the largest source of Federal Assistance for the construction and rehabilitation of affordable rental housing in the country since 1986, with approximately 3.8 million units built through the source. There is a need for 1.86 million new homes per year in the USA until 2033.

Conversion Programs

There are also attempts to convert commercial properties into residences. 35 billion dollars have been allocated for this purpose. But it is not used now. There are many permitting processes and environmental review processes. Converting commercial properties into residential can be a hassle, but it is possible – and may even be cheaper. According to Commerical Observor, construction costs for a top-down residential development in Manhattan can run between $500 and $600 per square foot, while conversions typically cost between $300 and $400 per square foot.

*The article in question was compiled for ParaAnaliz by translating from the article “Why We Have a Housing Crisis” published by Kyla Scanlon on her personal blog.