CoinDesk 20 Index: 2,056.00 +1%

Bitcoin (BTC): $67,818.38 +1.35%

Ether (ETH): $2,625.15 +0.85%

S&P 500: 5,841.47 -0.02%

Gold: $2,709.71 +0.59%

Nikkei 225: 38,981.75 +0.18%

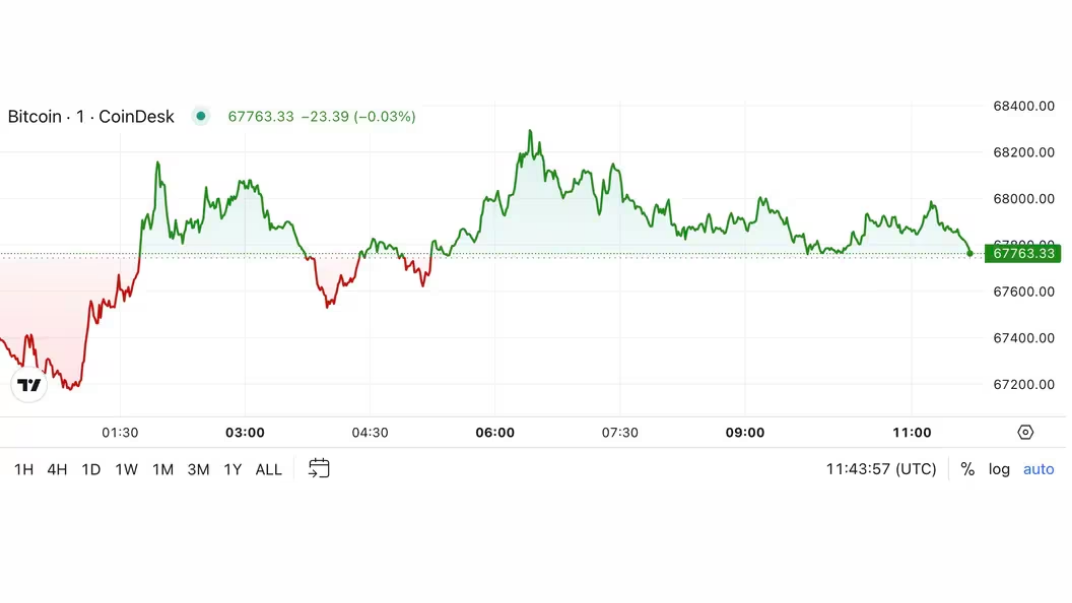

Bitcoin made another attempt to stay above $68,000 in the early morning hours just before pulling back and trading around $67,800. BTC gained approximately 1.35% in the last 24 hours, outperforming the digital asset market as measured by the CoinDesk 20 Index, which rose approximately 0.8%. Bitcoin is up nearly 9% this week, driven by strong buying into spot BTC ETFs, according to CoinDesk Indices. According to data compiled by SoSoValue, US-listed funds have seen inflows of $1.86 billion since Monday, the highest figure since the second week of March.

According to Bold.report, global ETPs recorded cumulative inflows of 25,675 BTC ($1.74 billion) over seven days, the highest seven-day inflow seen since July. Bitcoin ETPs currently hold 1.1 million BTC, which is the same amount found in Satoshi’s wallet. ETPs identify funds such as exchange-traded funds (ETFs) and exchange-traded notes (ETNs) under a common umbrella. Bitcoin is up 15 percent since the October 10 low, according to CoinDesk data, and is just 8 percent away from its all-time high set in March. The rally is being led by several factors, including expectations of a Fed rate cut and the increasing likelihood that crypto-supporter Donald Trump will win the US Presidential election on November 5.

Dogecoin (DOGE) made a big splash when Elon Musk announced his proposed “Department of Government Efficiency” (DOGE) plans at the Pennslyvania city hall. DOGE rose 7% to above 13 cents for the first time since the end of July, outperforming the general market and bitcoin’s 1% increase in the last 24 hours. It increased its weekly gains to over 22%, which is the highest among all major tokens. The number of DOGE open positions (the number of outstanding futures bets) rose above 5 billion, indicating that volatility was approaching. An increase in the number of open positions along with higher prices indicates that the market trend is strong.

The chart shows daily bitcoin transaction fees in USD and the price of BTC. Transaction fees rose to $67,300 yesterday, the highest single-day figure since August 22. The rise in Bitcoin-based memecoins may be contributing to the increase in transaction fees, according to IntoTheBlock .Source: Artemis