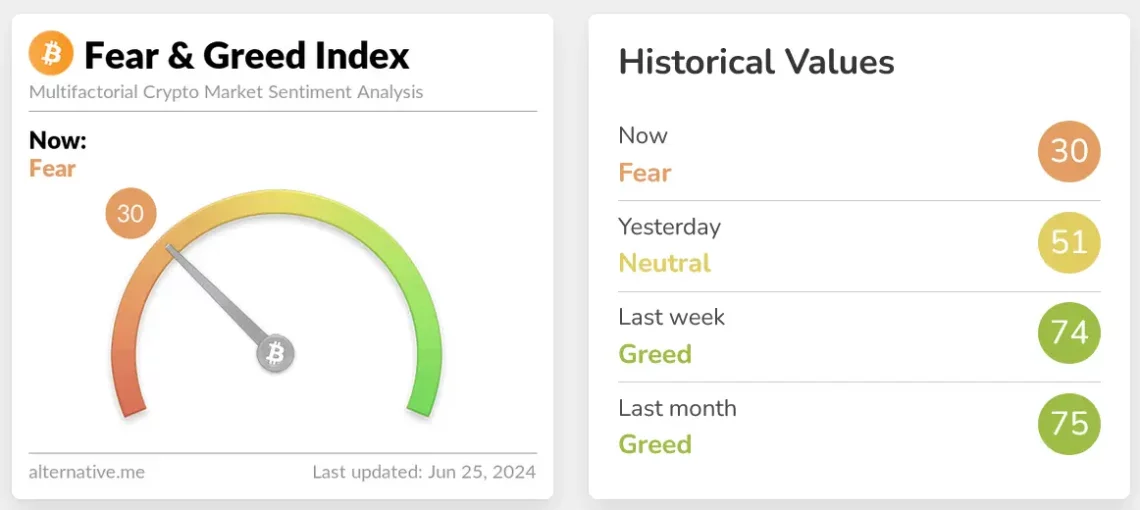

Bitcoin (BTC)and the Crypto Fear and Greed Index, which measures market sentiment towards altcoins, hit its lowest point in nearly 18 months.

The index fell 21 points on June 24, reaching “Fear” territory, marking one of the biggest daily declines in recent years.

It was last in the Concern zone (one point between 24 and 50) about seven weeks ago, on May 3, but has not fallen below 30 since January 11, 2023. At that time, Bitcoin was a cryptocurrency exchange FTX It was trading at $17,200 just two months after the collapse of . This time last week the score in the “Greed” zone was 74.

News flow draws Bitcoin (BTC) side

BitcoinIt is currently trading at $60,300 after falling to a seven-week low on June 24.

The concern among crypto investors comes amid outflows in spot Bitcoin ETFs. Mt. Gox may be preparing to sell $8.5 billion worth of Bitcoin to its creditors, and the German government’s sale of BTC also shook the market. But an executive at cryptocurrency investment firm Galaxy Digital said Mt. Gox thinks there has been a strong reaction to his concerns.

Bitcoin miners are selling more Bitcoin than usual at a time when the network hash rate is falling, which may have contributed to weakening market sentiment.

The Crypto Fear and Greed Index factors in market volatility (25 percent), trading volume (25 percent), Bitcoin dominance (10 percent), and trends (10 percent). The score has been in a downward trend since reaching the 90 “Extreme Greed” phase on March 5, when Bitcoin surpassed $69,000, its all-time high price set in November 2021.