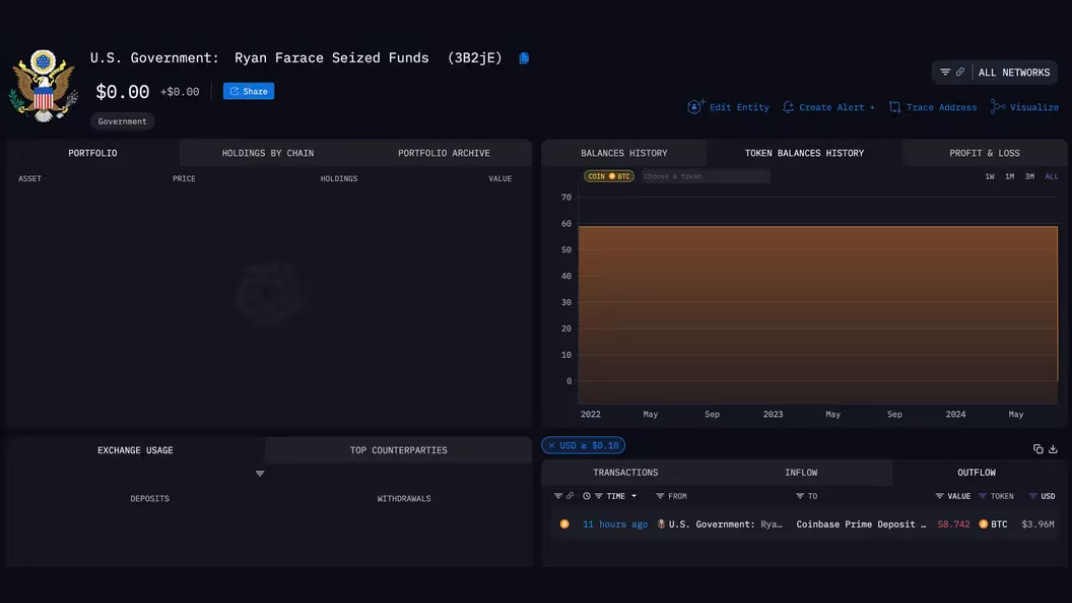

Bitcoin (BTC) erased all of last week’s gains by approaching the $66,000 level earlier in the day. Prices retreated as a significant portion of the asset was moved out of wallets linked to the U.S. government, raising fears of selling pressure among traders.

BTC lost as much as 5% before recovering after the US Marshals Service transferred $2 billion worth of BTC to two new wallets. Data tracking platform Arkham estimates that at least one of these wallets was a custody service.

Solana’s SOL token is also leading the losses among the majors, reversing yesterday’s gains with a 6% drop. The token’s prices continued to rise over the weekend, driven by memecoin trading on Solana, and on-chain trading volumes increased more than Ethereum.

” style=”height: 673px;”>

Other majors also recorded similar losses along with bitcoin’s decline, with Cardano’s ADA down 5%, dogecoin (DOGE) and BNB Chain’s BNB down 4%, while XRP lost 3%.

Ether remained strong with a 1% decline despite newly launched spot ETH exchange-traded funds (ETFs) seeing net outflows of $97 million for the fourth day in a row.

Market watchers say the lack of new catalysts along with macroeconomic decisions could act as headwinds to the market, pushing prices down in the near term.

“The market got a significant boost last week on expectations for Trump to mention BTC at the Nashville conference,” said Alice Liu, head of research at CoinMarketCap.

Republican candidate Donald Trump vowed to fire SEC chairman Gary Gensler and create a strategic bitcoin reserve during his speech at the Bitcoin 2024 Conference in Nashville on Saturday.

Declaring that he will be a “pro-Bitcoin” president, Trump emphasized that he will not allow any of the 213,239 BTC seized by authorities and held in US government wallets to be sold. According to Trump, the US will be the cryptocurrency capital of the world.

However, Liu said optimism peaked on the 27th, leading to a “sell the news” situation, adding “there is no expectation of new optimism in the market at present.”

Liu warned that interest rate decisions from three central banks — the Bank of Japan, the Federal Reserve, and the Bank of England — tomorrow and Thursday could further increase volatility in the crypto market.