Bond investors, resigned to the prospect of “higher-longer interest rates” in 2024, are looking to this week’s Federal Reserve meeting for clues on how to play in 2025 and beyond.

Treasuries rose on Tuesday as investors tried to parse policymakers’ latest three-month economic and interest rate projections, known as a dot plot, on Wednesday. As of March, officials were signaling a three-quarter point cut in 2024, but are expected to scale back that assumption in the face of strong economic data, including strong May job growth.

Hours before the Fed wraps up its two-day meeting, new data on inflation will show that prices are well beyond the central bank’s comfort zone. While the information gives the Fed little room to cut rates any time soon, investors are now debating whether future easing will mean only a minor policy shift by next year, as opposed to the series of cuts many expected.

The difference could have major market consequences.

“We will quickly turn the page to 2025,” said Kevin Flanagan, head of fixed income strategy at WisdomTree. “There might be one or two outages this year, but how many will there be next year?” Flanagan said. said. “As we enter the second half of this year, this bet will quickly come into the spotlight.”

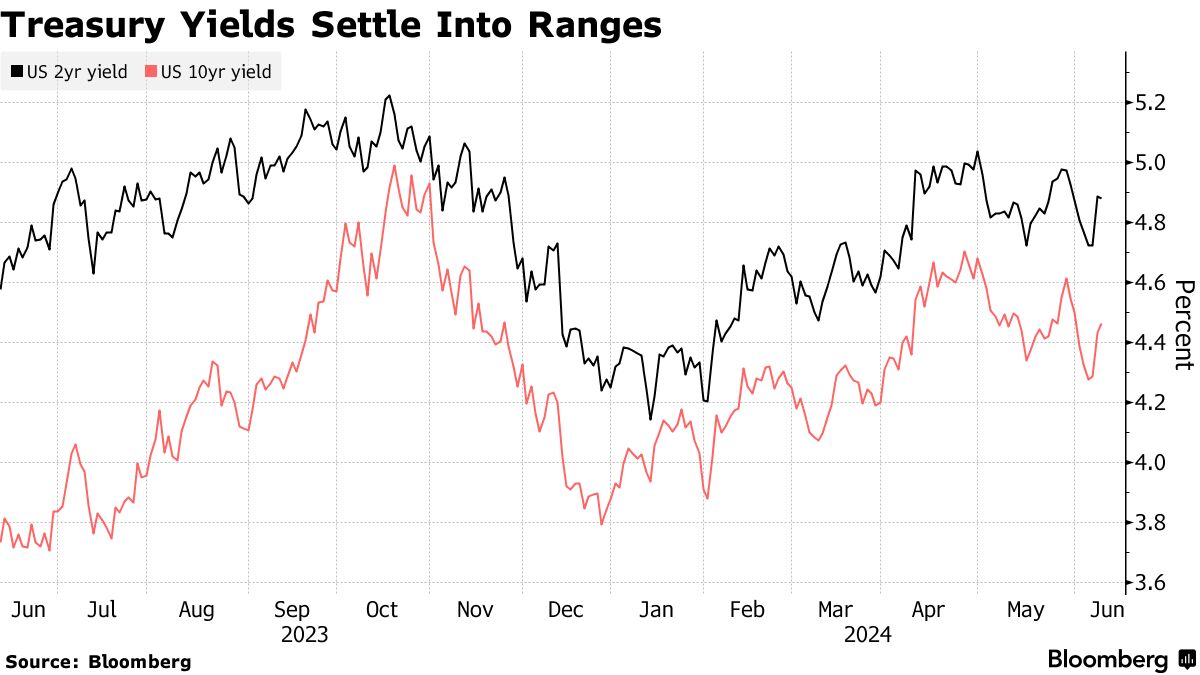

The Fed has maintained its highest policy rate range in two decades, between 5.25% and 5.5% since July, as the economy remains quite strong, with two-year Treasury yields just below 5% and 10-year yields at 4.5%. He watched around.

While the market was pricing in less than a two-quarter point rate cut for this year, the general intention was that an easing cycle would kick in as the economy eventually cooled. However, this situation started to change at the margins. Processes indicating that Fed policy rates will remain high next year and until 2026 have increased with the latest interest rate option processes.

Options traders have taken a more hawkish tone compared to their counterparts in the swap market, with March 2026 options targeting a Fed rate of roughly 5.75%, while swaps point to an interest rate of around 4% by then. BlackRock Investment Institute President Jean Boivin said the bond market should be cautious about predicting the eventual arrival of a “delayed easing cycle,” given the possibility of inflation running above the Fed’s 2% target. He said the bond market faces the possibility of “adapting to the fact that this is a shallow cycle of disruption.”

While the market was pricing in less than a two-quarter point rate cut for this year, the general consensus was that an easing cycle would kick in as the economy eventually cooled. However, this situation started to change at the margins. Processes indicating that Fed policy rates will remain high next year and until 2026 have increased with the latest interest rate option processes. Options traders have taken a more hawkish tone compared to their counterparts in the swap market, with March 2026 options targeting a Fed rate of roughly 5.75%, while swaps point to an interest rate of around 4% by then. BlackRock Investment Institute President Jean Boivin said the bond market should be cautious about predicting the eventual arrival of a “delayed easing cycle,” given the possibility of inflation running above the Fed’s 2% target. He said the bond market faces the possibility of “adjusting to the fact that this is a shallow cycle of disruption.”

“It’s the points that matter,” says David Robin, a strategist at TJM Institutional who has worked in debt derivatives markets for decades. “It’s either two breakthroughs or lower. “And we wouldn’t be surprised to see at least two or three points down the line, or not at all, for 2024.”

The economy’s resilience and loose financial conditions despite the 5%-plus Fed funds rate have encouraged talk that policy is not truly restrictive and may need to rise. Read More: El-Erian Says Strong Employment Data Closes Door to July Rate Cut “The debate about whether politics is restrictive will continue as the data is generally mixed,” said Priya Misra, portfolio manager at JP Morgan Asset Management. “There is a strong labor supply, but consumer confidence and hiring intentions from small businesses are weakening.”

As for the points, he expects the FOMC to signal a median of two cuts for 2024 and three in 2025, and for “Chair Powell to emphasize that the points are a function of the data, not a bet.” Higher Long-Term Rates Mark Dowding, chief investment officer at RBC BlueBay Asset Management, is focused on the Fed’s last rate, which he thinks is too low at 2.6%. Fed officials raised their outlook for the long-term policy benchmark from 2.5% to 2.6% in March. “We’re in a world right now where inflation continues to get very high,” and that long-term point is shifting from “somewhere north of 3%” to 2.75%. A market closer to the Fed’s expectations for its interest rate path has Dowding advocating caution on longer-dated Treasuries “largely due to debt levels in the U.S.”

That’s why he favors steepening trades, where short-term returns fall faster than long-term debt – but this positioning hasn’t worked as of late. “We think eventually the chickens will come home to roost and you’ll see the curve steepen a little bit,” he said. Kristina Hooper, chief global market strategist at Invesco, said she does not expect a very aggressive rate-cutting cycle. Instead, he sees a “more gradual” pace that would support an environment for risky assets and a renewed acceleration in economic growth. “Every day that the Fed doesn’t cut interest rates has a spiritual and real impact on the economy,” Hooper said at Invesco’s mid-year outlook invitation on Monday. “That said, I think the U.S. economy is resilient.”