CoinDesk 20 Index: 2,140.40 -0.60%

Bitcoin (BTC): $72,289.97 +0.11%

Ether (ETH): $2,631.15 -1.26%

S&P 500: 5,813.67 -0.33%

Gold: $2,778.66 -0.35%

Nikkei 225: 39,081.25 -0.5%

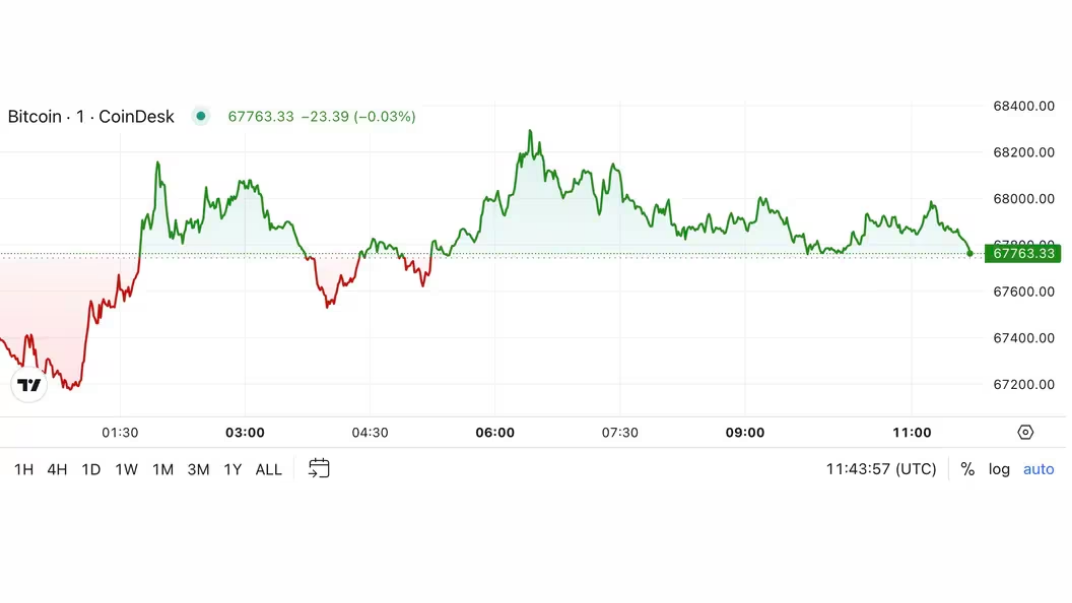

Bitcoin (BTC) is breathing a sigh of relief as October comes to a close, trading around $72,500, up about 0.3% in European morning trading. The digital asset market tracked by the CoinDesk 20 Index is down about 0.9%, while ETH and SOL are losing 1.15% and 0.3%, respectively. Spot bitcoin ETFs recorded inflows of $893 million yesterday, marking the second consecutive day of inflows of over $850 million. Most of the inflows were into BlackRock’s IBIT fund, with $872 million.

Traders see net inflows in ETFs as a sign of institutional demand as bitcoin dominance continues to grow. Augustine Fan, head of insight at DeFi platform SOFA, said: “Stocks are trading as if Trump won, even though the official odds are 50-50. Similar positive trends can be observed in gold and crypto prices, and skews may come to the fore as post-election hedging.” .” Skewness refers to the shape of the return distribution for financial assets. In the context of the options market, positive skewness indicates increased demand for call options relative to put options. This means more investors are buying options, betting on the asset’s price going higher.

The outcome of next week’s presidential election is of little consequence in the context of mainstream bitcoin adoption through ETFs, according to Darius Sit, chief investment officer of QCP Capital. While there will be some volatility depending on whether Donald Trump or Kamala Harris prevails, the broader integration of bitcoin into American finance through firms like BlackRock is far more important, Sit said in an interview at Hong Kong Fintech Week. he emphasized. “When BlackRock CEO Larry Fink talks about bitcoin on CNBC, that’s when we can say crypto has become part of American investing,” he said.

The chart shows the 365-day and 30-day moving averages of active bitcoin addresses. A “golden cross” forms when the second average crosses above the first and is traditionally an indicator of upward price movement. BTC’s six-month sideways movement is the 365-day cross of the 30-day MA. It coincided with the fall below the MA.Source: CryptoQuant