solanamemecoin Dogwifhat (WIF) experienced a 38 percent decline last week, worrying its investors.

On June 23, Dogwifhat’s market cap dropped 9 percent to $1.60 billion over a 12-hour period. Crypto trader lockgraze wrote in a post dated June 23, “Many people are talking about WIF being in the accumulation zone, but I checked the chart and there is no random accumulation,” he wrote.

WIF attracted attention with data on futures processes

Dogwifhat remains the fourth largest memecoin by market cap. According to CoinMarketCap information, WIF is trading at $1.62, down 38 percent in the last seven days.

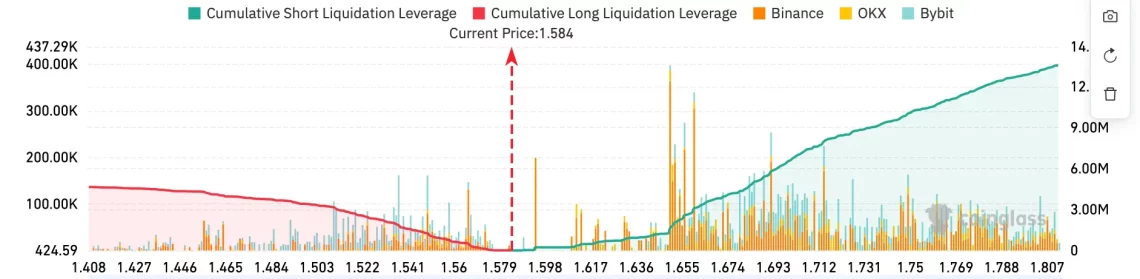

The price drop apparently caused futures investors to refrain from shorting Dogwifhat. According to CoinGlass data, Open Interest (OI), which is the total value of all outstanding or unpaid Bitcoin futures contracts on exchanges, decreased by 25 percent in the same period to $209.64 million.

If it recovers by approximately 13 percent compared to its price two days ago and reaches the level of $ 1.81, approximately $ 13.53 million in short situations will be deleted. This feeling has changed significantly in the last few months; Dogwifhat’s price tripled when it was trading at $3.

On March 14, when WIF broke the $3 barrier for the first time, Arthur Hayes, former CEO of BitMEX and current chief investment officer of Maelstrom, said: solana He predicted that based memecoin would rise to $10. “Hat stays on while I count to $10,” Hayes said in a March 14 X post.

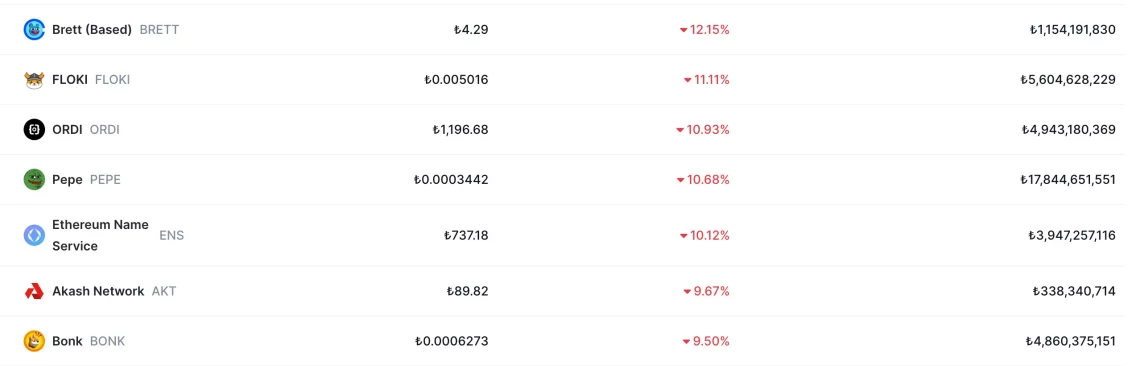

The biggest decrease came in memecoins

When we look at the information obtained from CoinMarketCap, the cryptocurrencies that lost the most value in the last 24 hours were mostly memecoins. BRETT, the most well-known memecoin of the Base network, is 12.15 percent, FLOKI, the precious name of dog memecoins, is 11.11 percent, PEPE, the current main memecoin of the Ethereum network, is 10.68 percent, and BONK, the well-known face of the Solana network, is down 9.50 percent in a short time. lived.

Memecoins, which have recently entered the phase of excess with the influx of celebrities, seem to have learned a sufficient lesson from this retreat of the market.