US investors are eager to invest in exchange-traded funds (ETFs) that hold cryptocurrencies, according to a new survey by financial services giant Charles Schwab.

Nearly 45 percent of survey respondents said they plan to invest in crypto through ETFs next year. The survey shows that demand for crypto ETFs exceeds demand for bonds and alternative assets. The only investment vehicle that outperformed crypto ETFs was US stocks, with 55%.

The leading asset class among millennial investors was crypto ETFs, at 62%. 48% of respondents reported investing in U.S. stocks, 47% in bonds, and 46% in real-world assets such as commodities.

Boomer ETF investors reported little interest in digital assets, with only 15% of survey respondents saying they were considering investing.

Eric Balchunas, senior ETF analyst at Bloomberg Intelligence, said it was “quite striking” that crypto was at the top of investment plans in the survey.

” style=”height: 754px;”>

The results of the survey, which asked 2,200 individual investors ages 25 to 75 to invest at least $25,000, could be a significant boost to the emerging and growing class of crypto-focused ETFs that stand out as a diversification tool for traditional stock and bond investment portfolios.

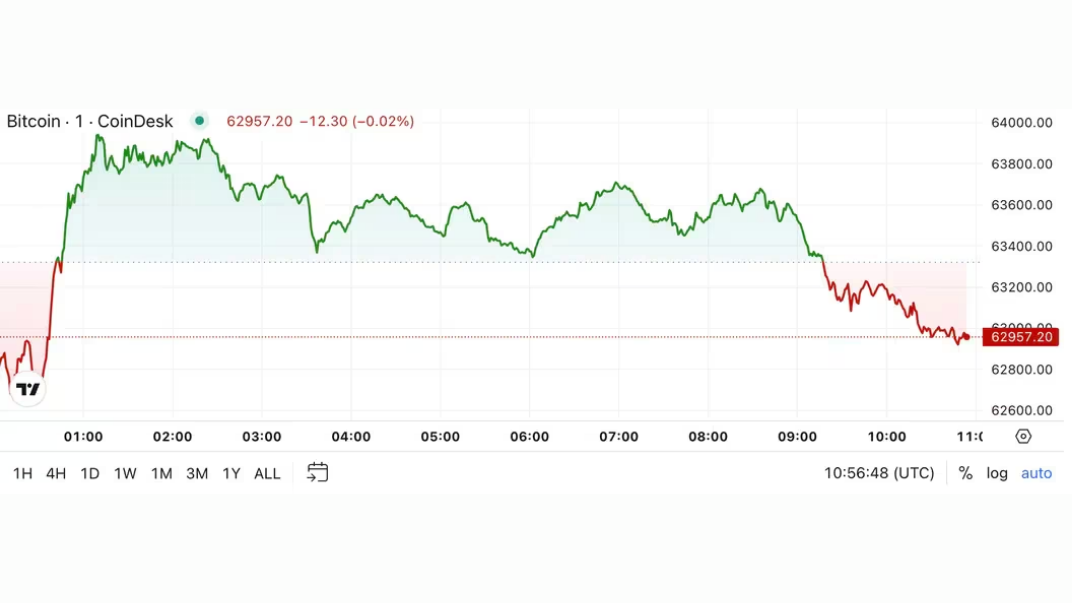

U.S.-listed spot bitcoin ETFs have attracted net inflows of about $19 billion since their launch in January, while spot ether ETFs have become increasingly weaker since their launch in July. According to Farside Investors, outflows recorded by Grayscale Ethereum Trust outweighed inflows, with cumulative net outflows exceeding $500 million.