The technology industry is one of America’s most advanced and fastest growing industries. It is a department that contributes greatly to global innovation.

During the pandemic, industry growth and hiring activity have increased wildly. However, the branch has been plagued with serious problems since then. The “tech recession” began with the tightening of monetary policy, the decline in online activity growth caused by the pandemic, increased macroeconomic uncertainty, and the collapse of valuable tech financial institutions.

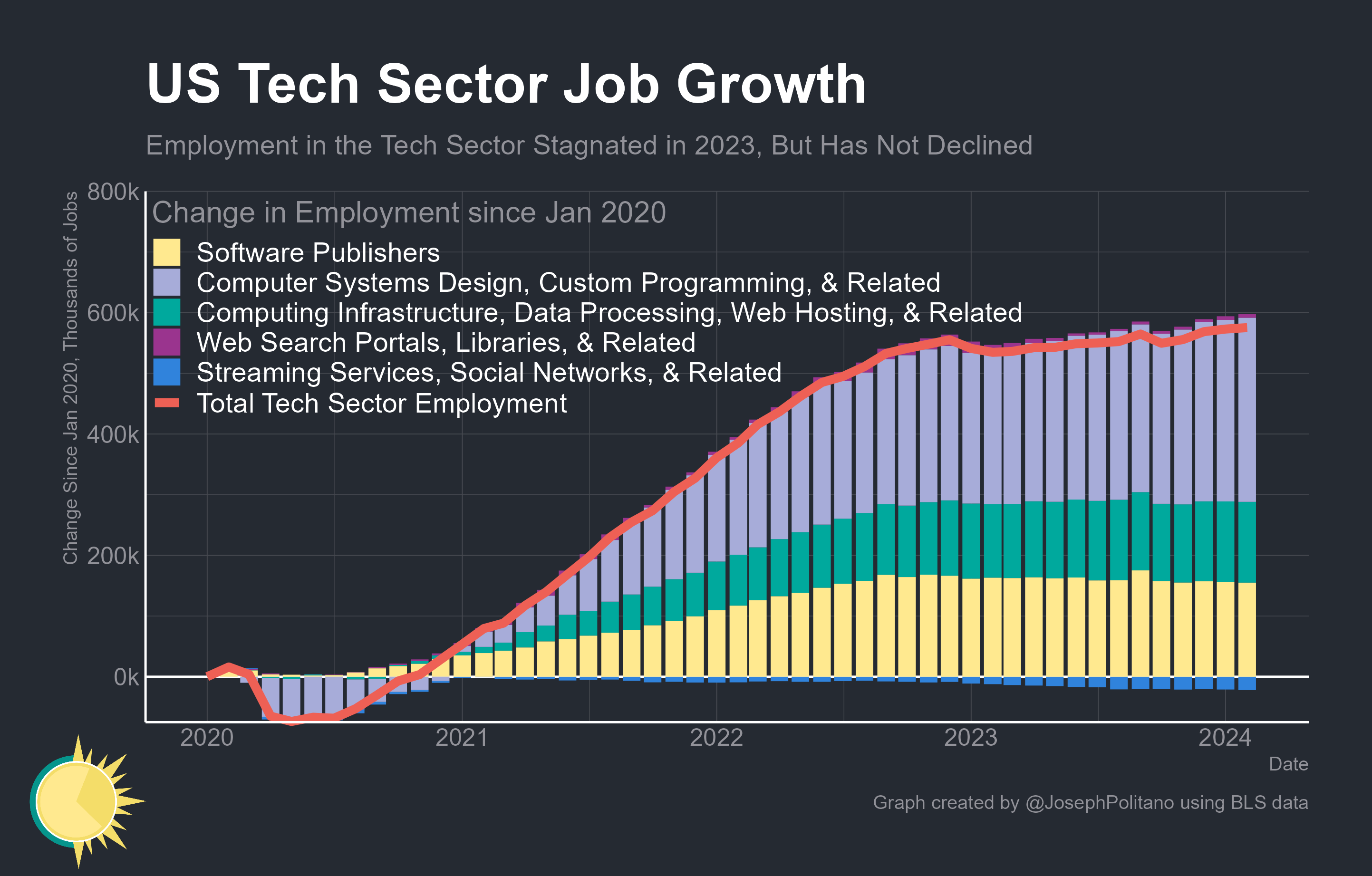

However, the US has not actually seen a significant decline in tech employment.

New employment numbers in the sector:

- A total of 308 thousand in 2021,

- 180 thousand in 2022,

- Only 32 thousand in 2023.

The slowdown in the US tech industry has been felt by workers more than once in the form of reduced hiring and wages.

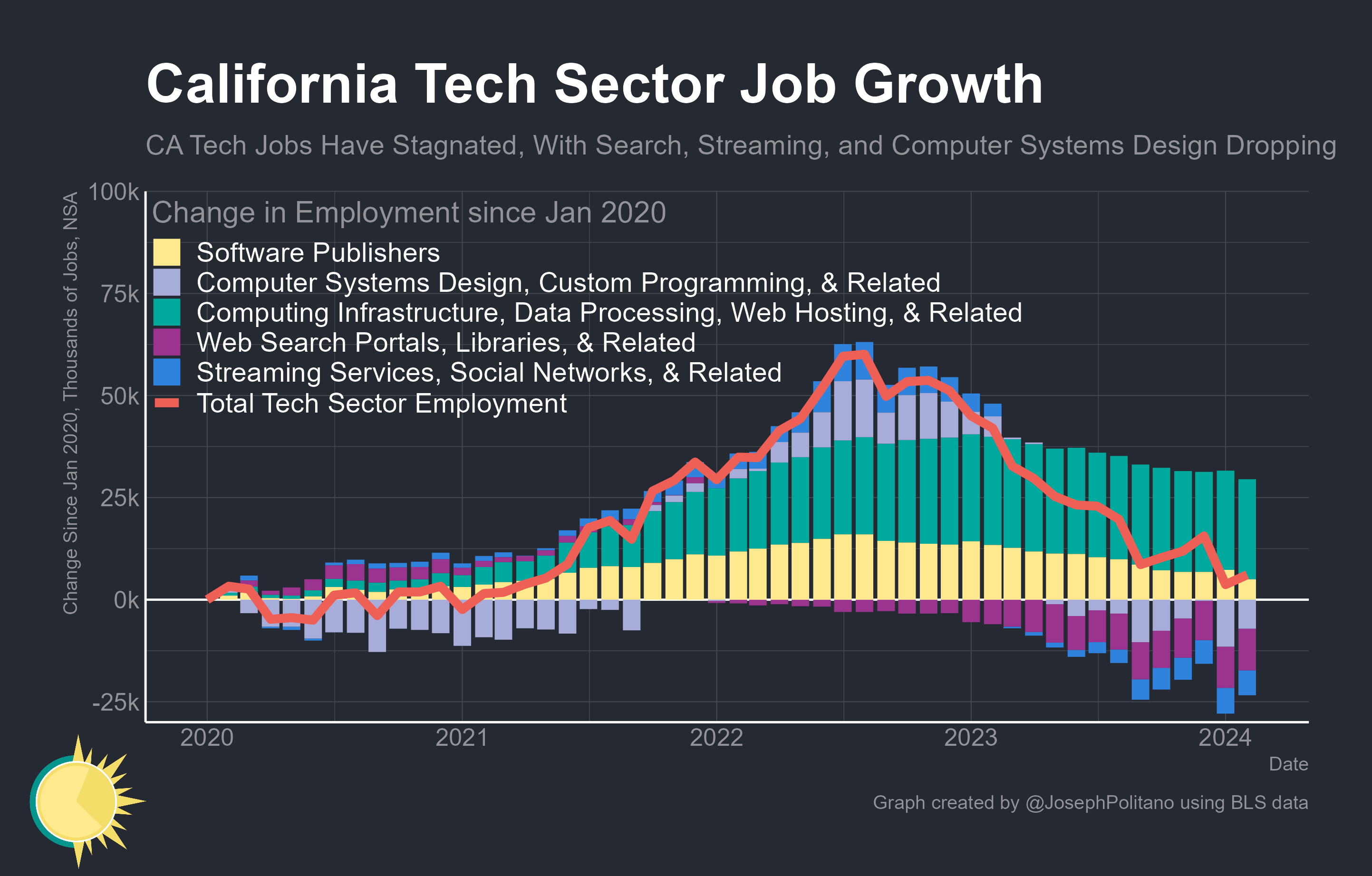

California – Tech-cession

Many of the classic centers of the technology industry have suffered significant losses since the beginning of the technology recession. The place that suffered the most was California. Home to Silicon Valley, this state represented nearly 30% of U.S. tech output in 2021 and accounted for nearly 10% of the state’s total GDP from the tech industry.

However, in the last year and a half California,

- 21 thousand in computer systems design and related fields,

- 15 thousand in broadcasting and social networks,

- 11 thousand in software publishing

- 7,000 jobs lost in web search and related fields.

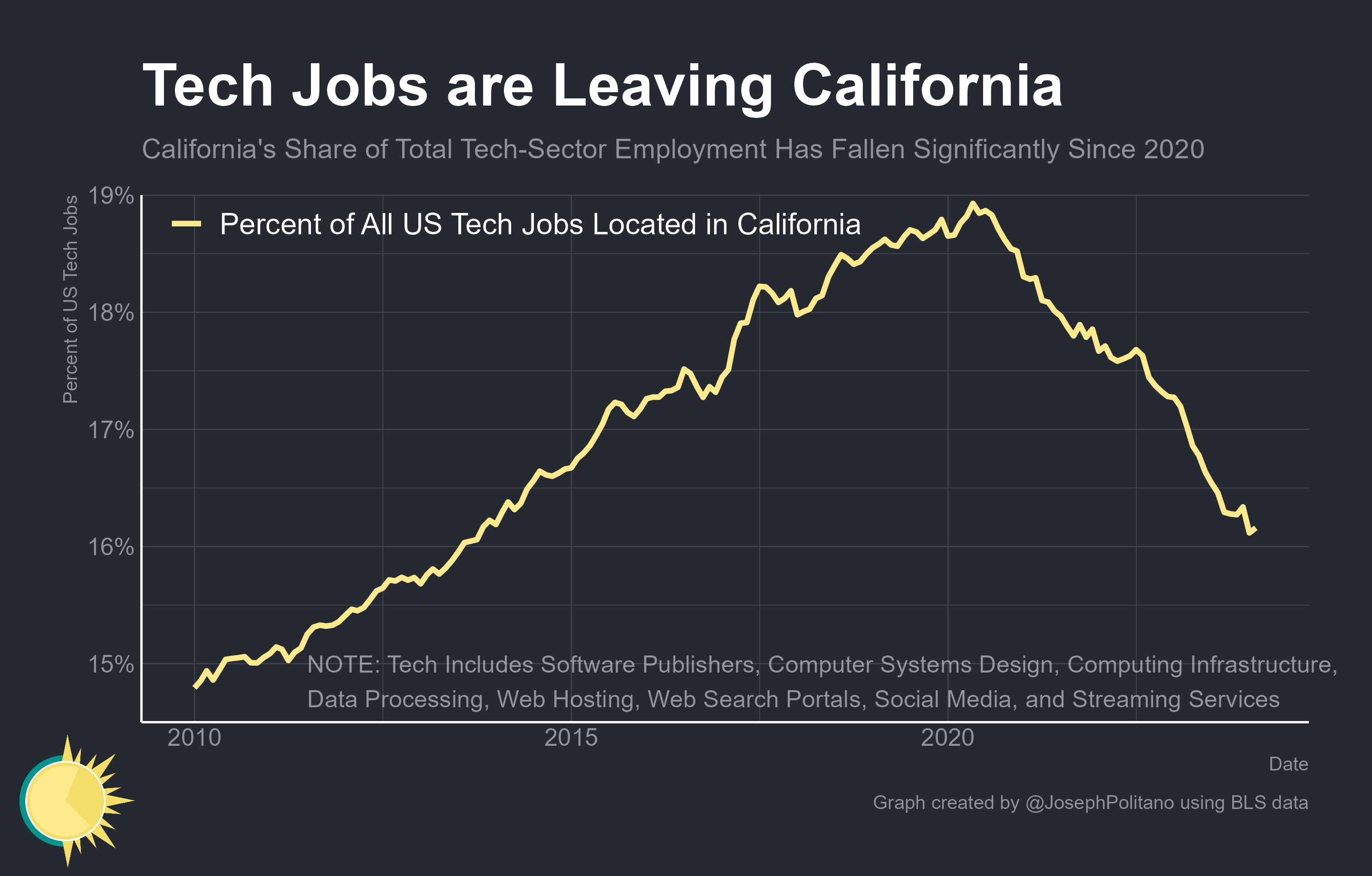

Since the start of COVID, there have been just 6,000 new jobs overall in the California tech industry. In the rest of the USA, there was an increase of approximately 570 thousand jobs.

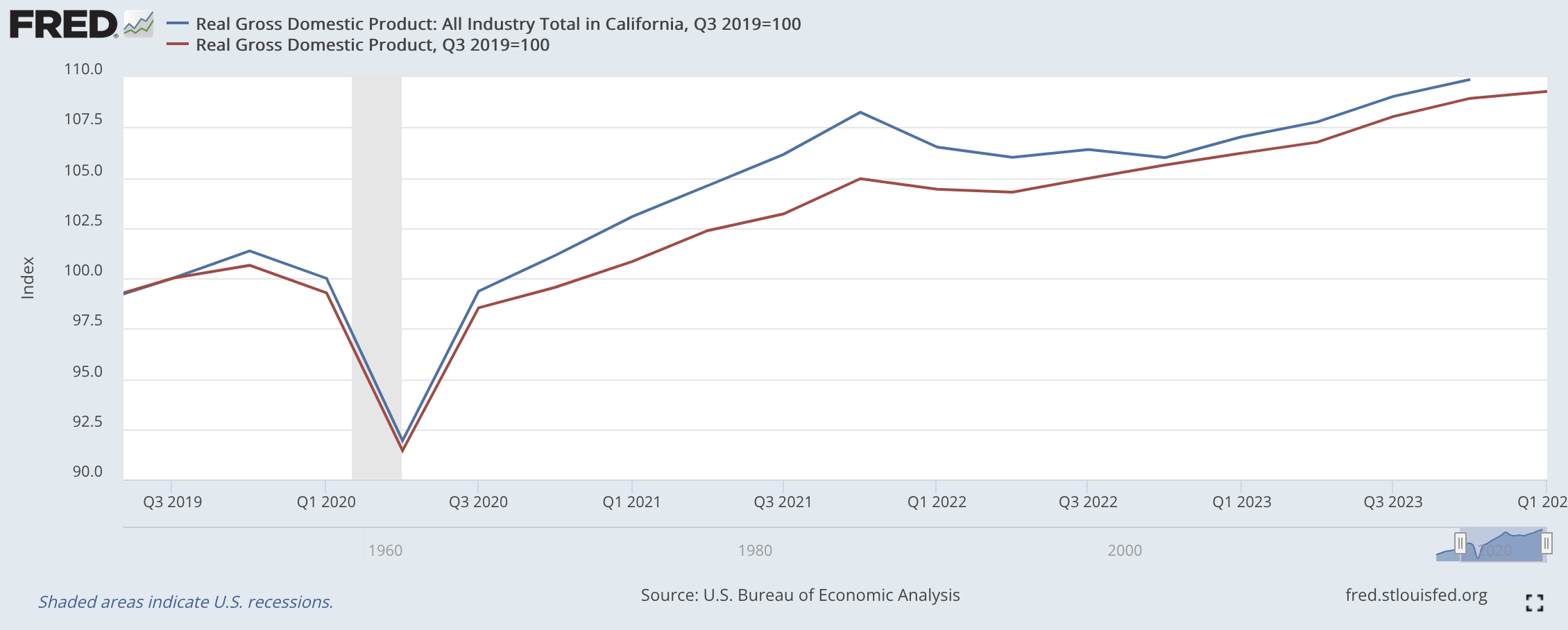

There has been a widespread economic slowdown in California. The state’s GDP fell 2.1% through 2022. This decline was the second largest in any state during the period.

Stagnation in the Housing Market

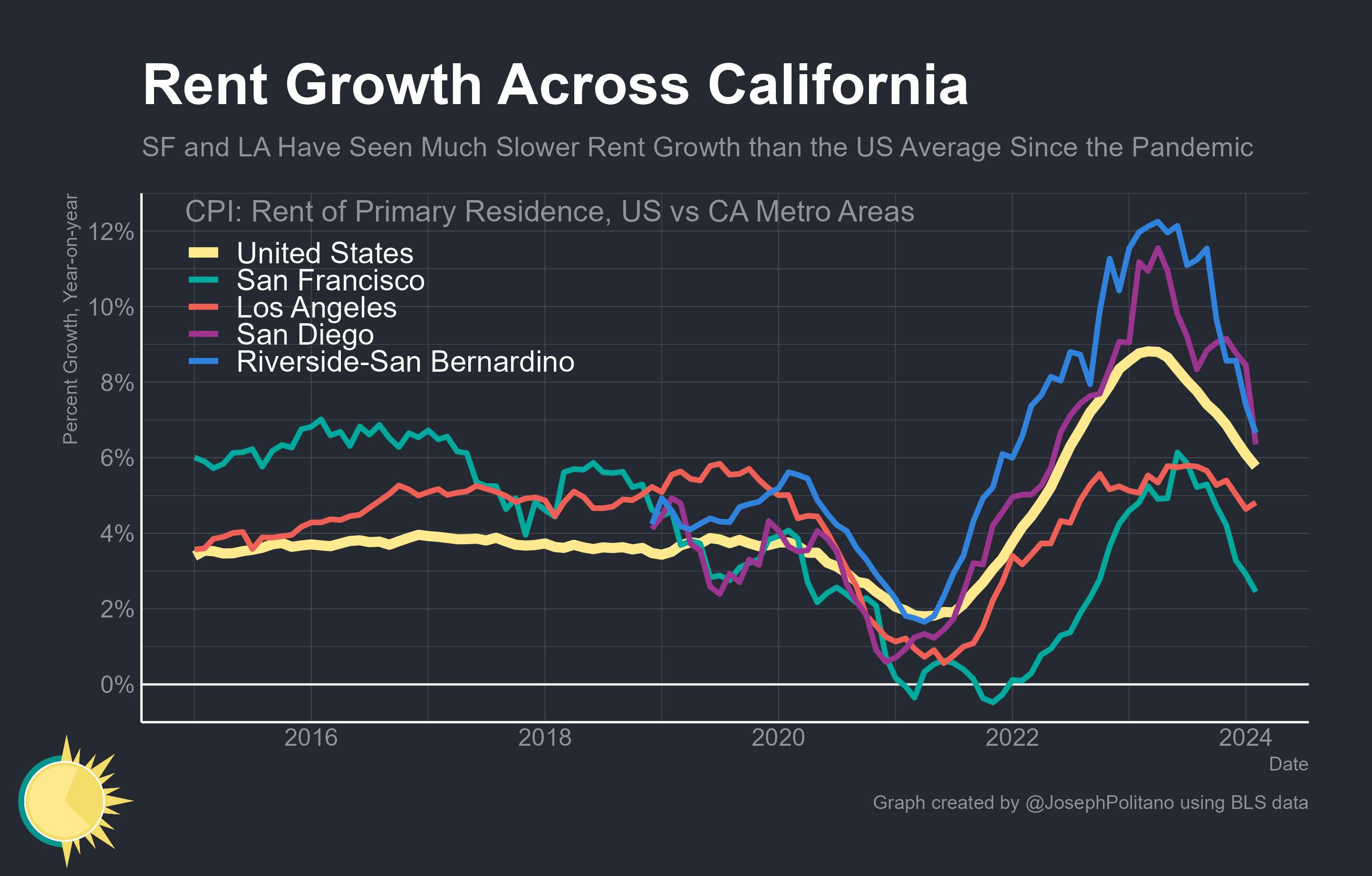

The general exodus of tech jobs from California has also significantly impacted the state’s housing market.

Rental price increases in the San Francisco (and Los Angeles) area were often much higher than the national average in the last half of the 2010s, but have been well below the national average since the start of the pandemic, as remote work has allowed many people to move for cheaper housing elsewhere in the US remained.

Rental prices in the San Francisco area also calmed significantly last year. These changes also affected housing prices. Home prices in the city of San Francisco are at their lowest levels since 2017 and are down more than 17% from their peak in mid-2022, Zillow claims.

Housing price growth across California has lagged behind the national average since mid-2022, falling 0.5%. In the same period, national prices increased by 2.5%.

California’s loss of tech jobs also has a significant impact on the state’s public finances, which are heavily dependent on Silicon Valley. In 2021, deductions from large publicly traded technology companies accounted for 7% of the state’s total income tax revenues.

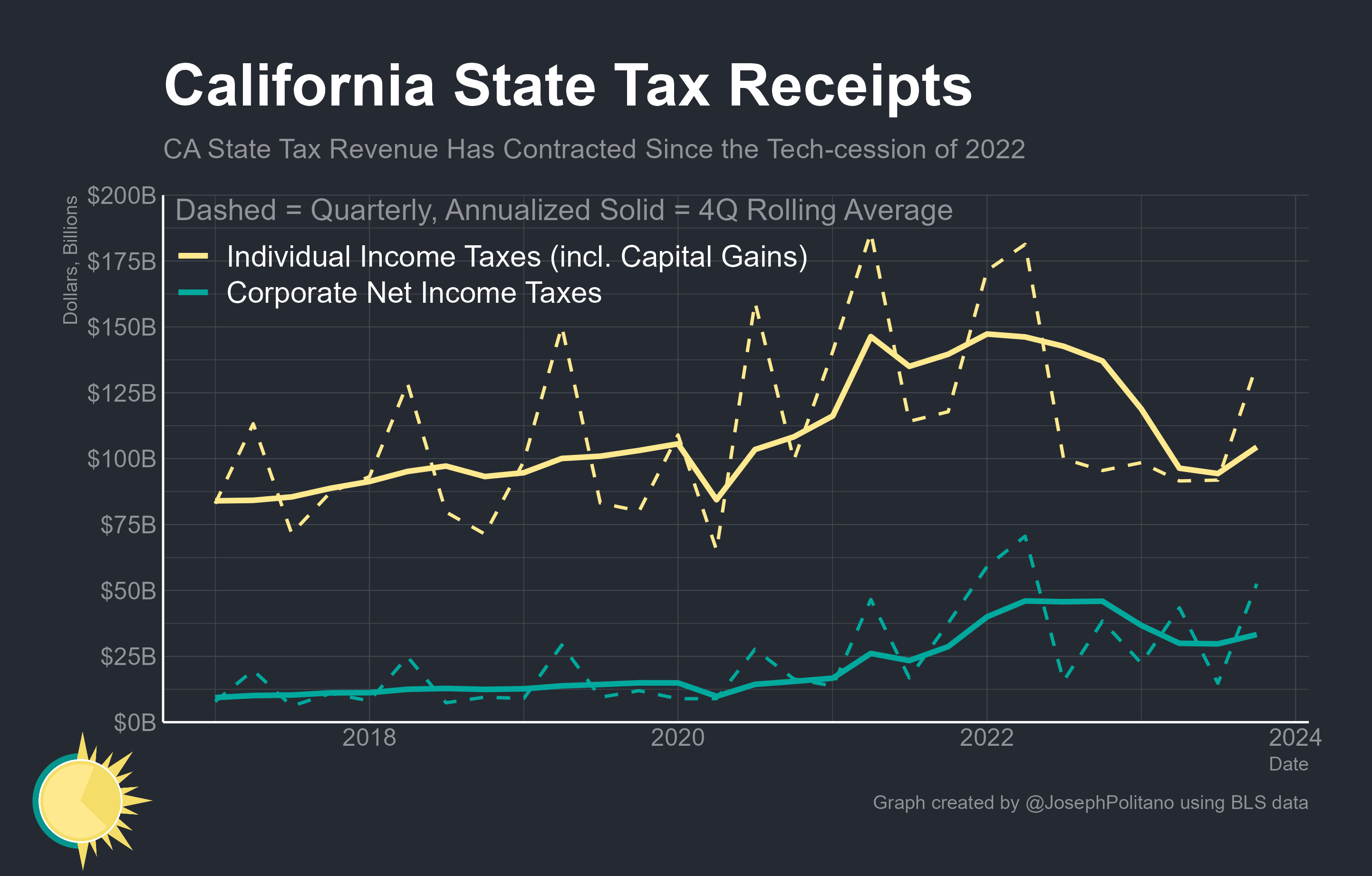

California’s calendar-year income tax revenues fell by $34 billion between 2022 and mid-2023 as the tech calm intensified. Corporate net income tax revenues also fell by $13 billion. Facing significant consecutive annual budget deficits this year, California has been forced to tap into its fiscal reserves and cut or delay several state spending projects on infrastructure, education, healthcare and climate projects.

In the short term, the state hopes for further tech recovery and the reopening of the IPO window.

But the fact that the US tech industry is now less structurally concentrated in California poses a potential risk. Less potential future revenue will result in increased state tax rates or decreased spending on investment and community services.

Hope for Recovery

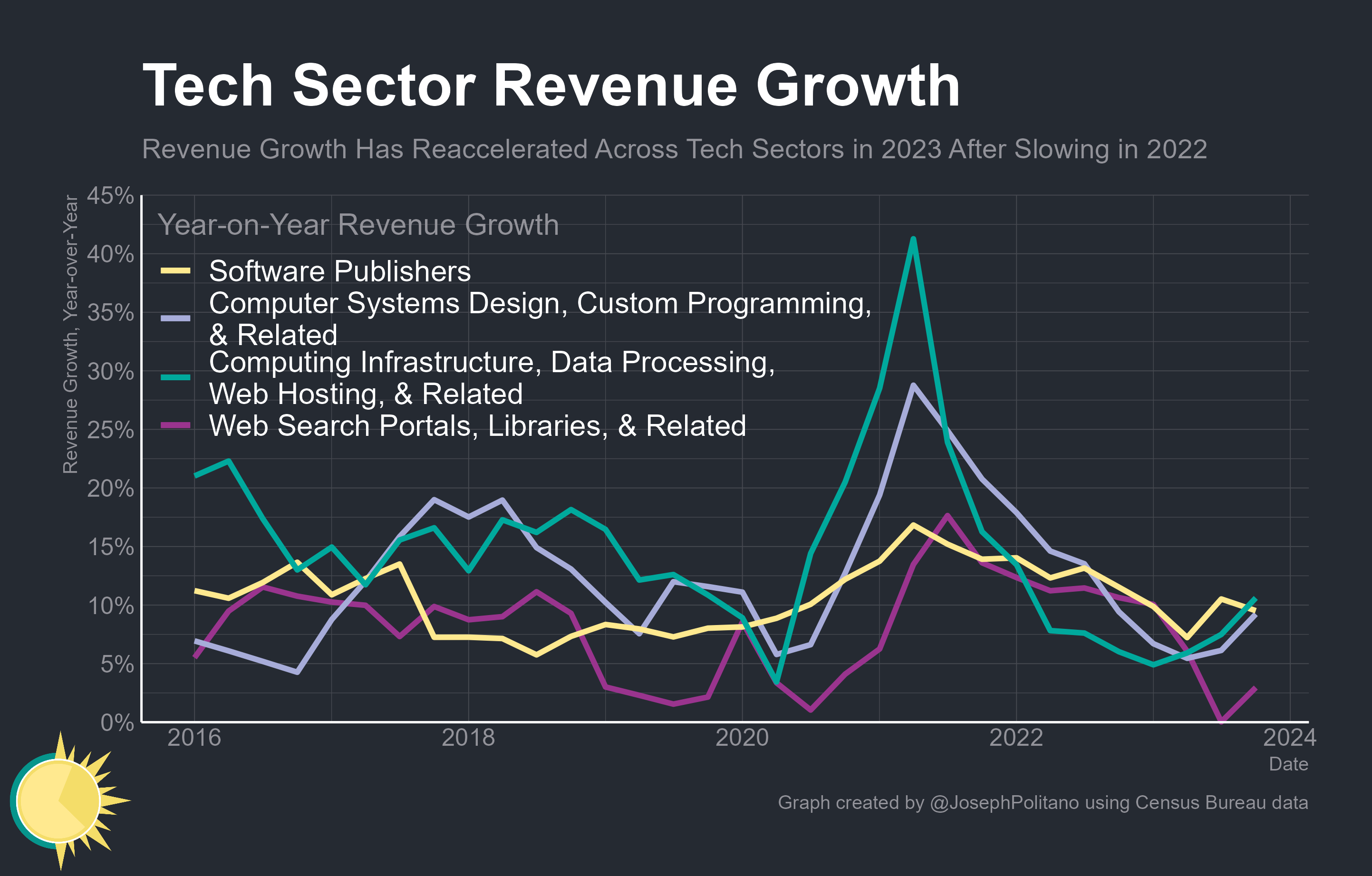

There is a possibility that California could see a short-term tech rebound as much of the US tech segment has now recovered from the 2022 slowdown. Revenue growth at information process infrastructure providers and information processors, software publishers, computer systems designers, and web search portals has rebounded from post-pandemic lows.

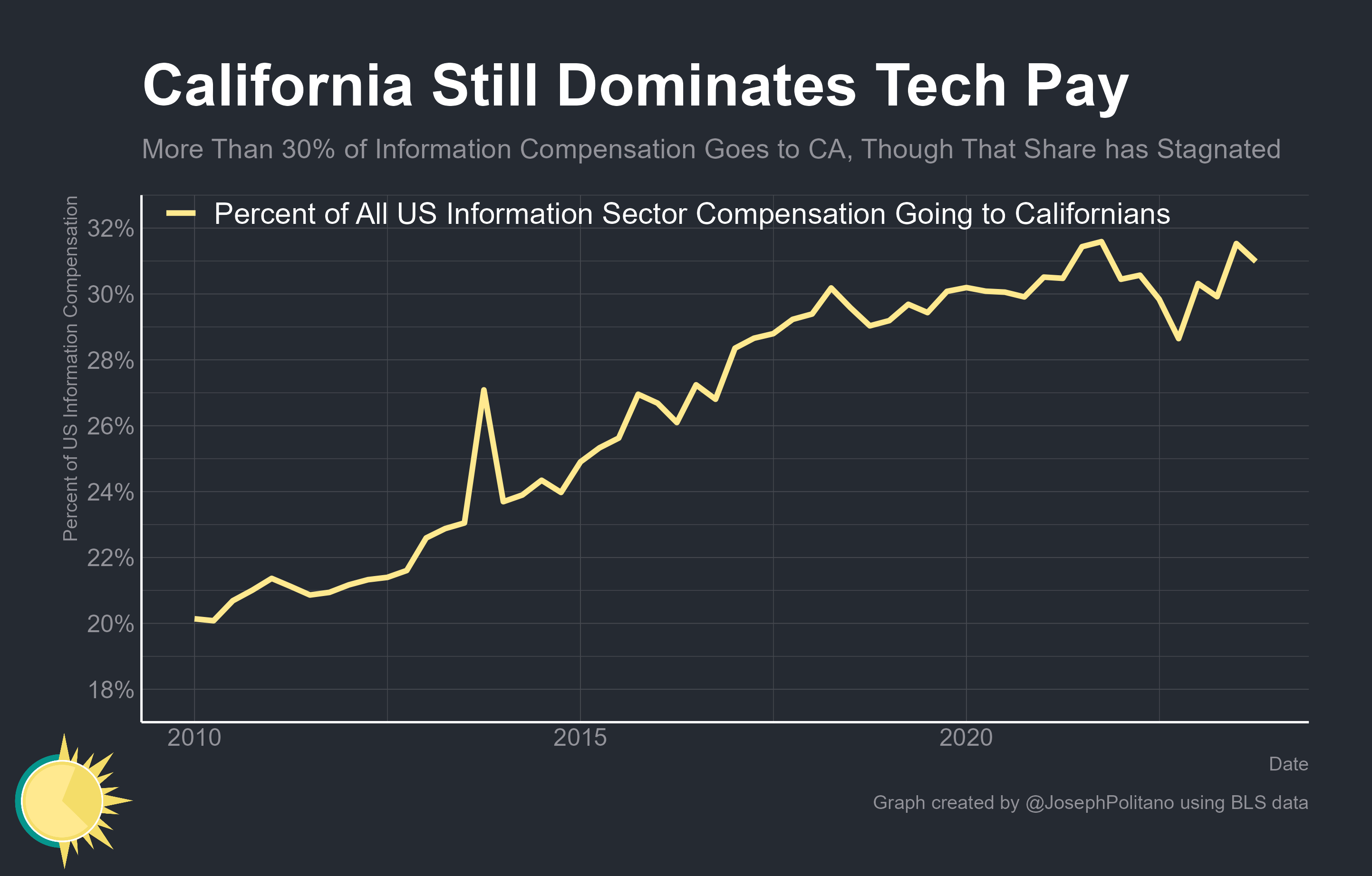

Although California has lost significant tech jobs to other states, it still maintains a big advantage at the top of the field.

While the IT sector (Information compensation) constitutes 18% of national employment, it corresponds to 31% of total employment in California.

In 2022, the average California worker in the software publishing industry earned $247,000, including stock options and bonuses, while the average non-California worker earned just $176,000.

Cumulative GDP growth in California since the start of COVID has been 9.9%. The national average was 8.9% in the same period.

California’s long-standing problem is not that its economy is failing or lacking dynamism, but rather that the state’s economic success refuses to accommodate everyone.

Residential owners, in particular, are imposing hard caps to protect property values no matter how much the state’s economy grows.

Since the start of the pandemic, Texas has built half a million more homes than California, and the Austin metro area has built 100,000 more homes than the entire Bay Area.

It’s no surprise that California is losing tech jobs to Texas.

*The article in question was compiled for ParaAnaliz by translating from the blog page Apricitas Economics.