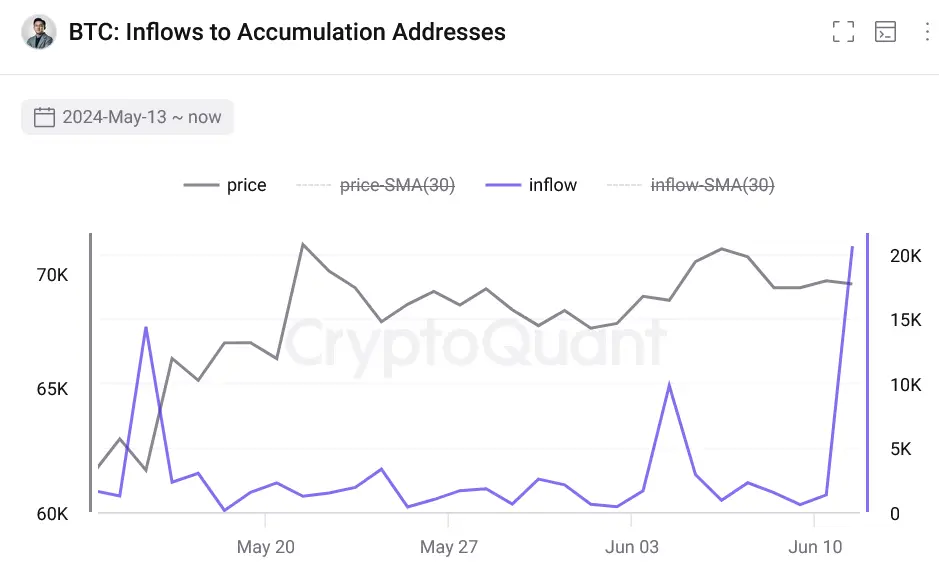

Bitcoin whales took full advantage of the drop in Bitcoin prices on June 11 and accumulated a total of 20,600 BTC worth $1.38 billion.

This was Bitcoin’s biggest entry day for whales since February 28, according to blockchain analytics firm CryptoQuant. Spot Bitcoin ETFs are now six weeks old and BTC is near its all-time high.

While inflow to Bitcoin whale wallets hovered in the mid-1,300 to 2,200 BTC per day, Bitcoin fell from $71,650 on June 7 to $69,000. The price fell again days later, leading to a massive day on June 11 when 20,600 Bitcoins flowed into whale accumulation addresses.

Data is now not updated for June 12; Bitcoin price rose for a short time following the US Consumer Price Index results, which were better than expected. As of the writing of the news, Bitcoin is trading at $67,500.

According to onchain analysis platform Santiment, Bitcoin’s supply on cryptocurrency exchanges has fallen to 942,000; this is the lowest since December 22, 2021. The decline in Bitcoin reserves is often an indicator of a strengthening market where investors expect upper price movement in the medium and long term.

Ethereum whales also came to life

Ethereum whales recently purchased more than 240,000 Ether. According to crypto analyst Ali Martinez, based on Santiment information, it is worth approximately $ 840 million at current prices.

But unlike Bitcoin, Santiment said that the supply of Ether on cryptocurrency exchanges has increased in recent days. According to Santiment data, there are currently 17.98 million Ether (worth $63.1 billion) on cryptocurrency exchanges. Ether fell 8 percent from $3,815 on June 7 to $3,510 at the time of writing.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making decisions.