Bitcoin (BTC)While , fell to the lowest level of the week ahead of US inflation data and the Fed meeting to be held today, US spot Bitcoin exchange-traded funds ( ETF‘ s) recorded their first net outflow after 19 process days.

According to Cointelegraph Markets Pro, Bitcoin has fallen 2.3 percent in the last 24 hours. BTC, which reached its lowest level in the last week, naturally created selling pressure on altcoins. BTCThe decline in ETH to $3552, LEFTto $154 and DOGEbrought it to $0.14.

The needle has turned on spot BTC ETFs

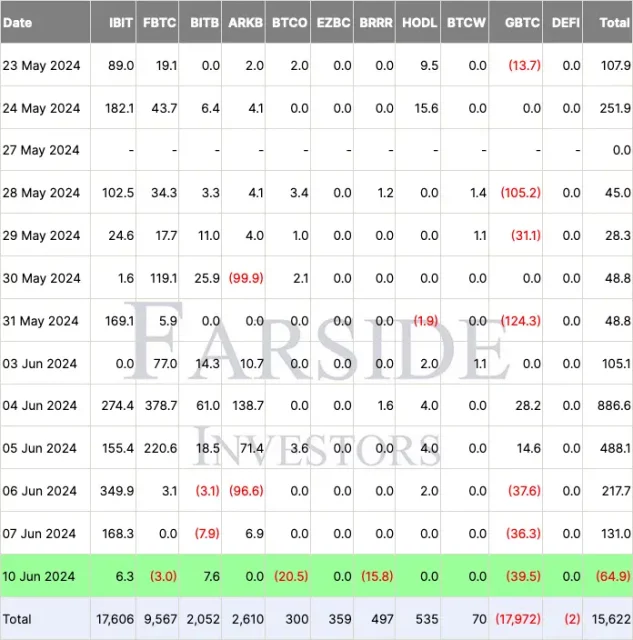

The decline in Bitcoin comes after 11 spot Bitcoin ETFs in the US recorded net outflows of $64.9 million on June 10, according to Farside Investors; This was the first net outflow in a month. Grayscale Bitcoin Trust (GBTC) led the way with a net outflow of $39.5 million, followed by a smaller outflow of $20.5 million from the Invesco Galaxy Bitcoin ETF (BTCO) and $3 million from the Fidelity Wise Origin Bitcoin Fund (FBTC). .

According to Morningstar, analysts assume that inflation will increase by 0.1 percent following the 0.5 percent increase in April and the annual number will rise to 3.4%, while core inflation will increase by 0.3 percent in May, the same as April. .

The Fed’s monetary policy will also be decided at the two-day Federal Open Market Committee (FOMC) meeting, which will start on the same day. Investment research company Zacks predicted that the Fed has no chance of cutting interest rates and that the central bank is expected to maintain its target rate of 5.25 percent to 5.5 percent, the highest level in 23 years.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making decisions.