Singapore has become the latest target of Akira ransomware. US Bitcoin ETFs purchased eight times more Bitcoin than was mined last week. Meanwhile, Bitcoin’s priority prices rose discontinuously above $50 on June 7.

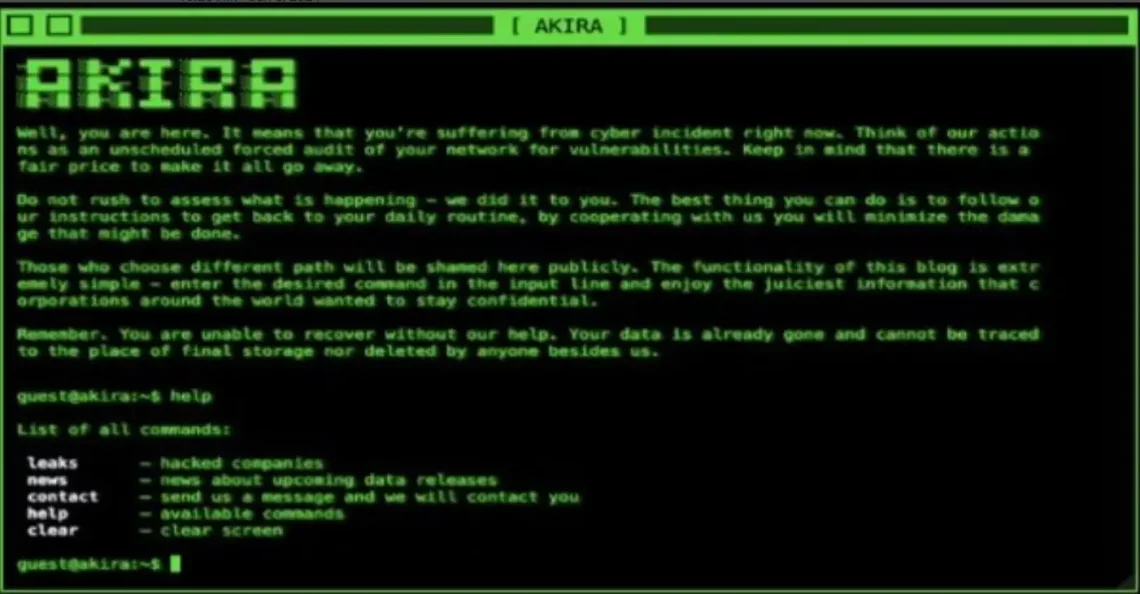

Singapore warns businesses of Bitcoin software risk

Ransomware Akira, which stole $42 million from more than 250 organizations in North America, Europe and Australia in one year, is now actively targeting businesses in Singapore. Singapore officials have issued a joint statement warning local businesses about the growing threat of the Akira ransomware variant.

The warning comes after agencies including the Singapore Cyber Security Agency, the Singapore Police Force and the Personal Data Protection Board recently received a number of complaints from victims of cyber attacks.

Previous investigations conducted by the United States Federal Bureau of Investigation revealed that Akira ransomware targets businesses and critical infrastructure organizations.

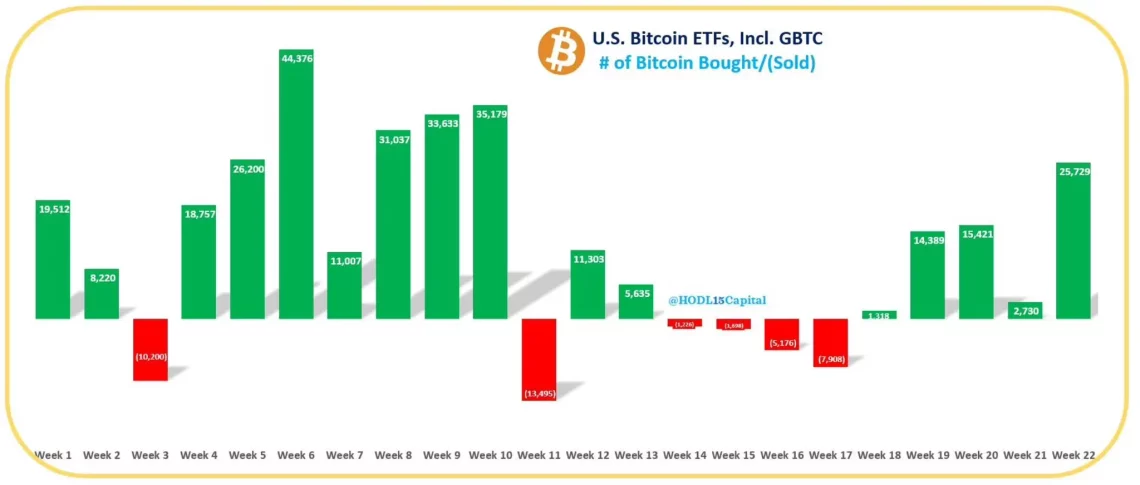

Bitcoin ETFs hit mining information in unexpected ways

According to HODL15Capital, United States Bitcoin exchange-traded funds (ETFs) purchased 25,729 BTC last week; This is approximately eight times the amount of BTC mined at the same time. This was also the biggest week of Bitcoin buying since mid-March, when Bitcoin reached an all-time high of $73,679.

ETFs reported net inflows of approximately $1.83 billion last week, with net inflows reaching $15.69 billion. This includes a net outflow of $17.93 billion from the Grayscale fund, according to Farside Investors.

But cryptocurrency exchange “Radar Bear” co-founder told Cointelegraph last week that the cryptocurrency is struggling to break past its current high because its price is “more influenced by macroeconomic factors and geopolitical events.”

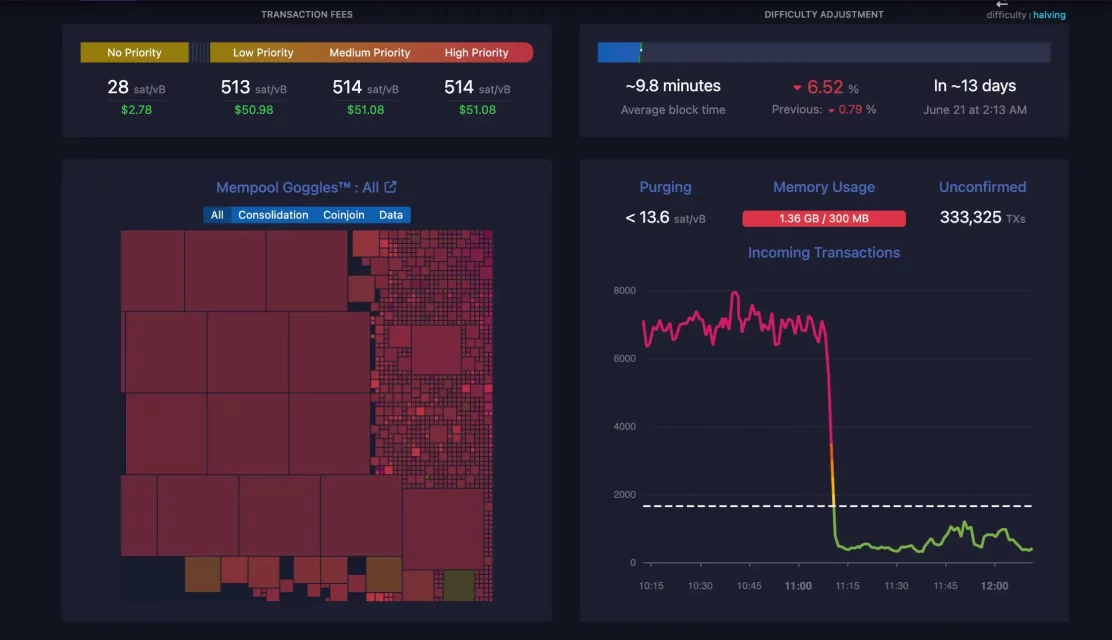

Bitcoin network process prices increase discontinuously

On June 7, the Bitcoin network experienced a sharp increase in transaction prices, largely driven by 332,000 unconfirmed transactions. According to blockchain analyst Colin Wu, the process backlog was due to crypto exchange OKX collecting and sorting wallets. But this has not been independently verified at the time of publication.

At its peak, high priority processes cost 514 satoshi, while low priority processes cost 513 satoshi. Process prices ranged from mid-$50 to $52 in US dollars.

The Bitcoin network held its fourth halving event in April, reducing the block reward from 6.25 BTC to 3,125 BTC. The halving, in which companies such as Bitfarms reported a large drop in revenue in May, appears to have put downward pressure on miners.

This article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should do their own research when making decisions.